Stop Profit Leaks: How to Tackle Amazon Vendor Chargebacks

Overview

Amazon Vendor Central can be a double-edged sword for brands and agencies. On one hand, it’s an unrivalled growth channel – over 90% of UK shoppers use Amazon regularly, with a significant portion shopping weekly. On the other, Amazon is,

“pretty ruthless. If you’re not looking in the right places at the right time, then you’re going to miss things,”

,as James Wakefield of WAKE Commerce warns. Nowhere is this more apparent than in the hidden profit leaks caused by Amazon vendor deductions. These charges – from compliance chargebacks to inventory shortage claims – can quietly erode your margins and even turn a profitable account into a loss.

In this article, we distill insights from a recent MerchantSpring webinar featuring Amazon vendor expert James Wakefield (Founder & MD of WAKE Commerce) and Paul Sonneveld (Co-Founder & CEO of MerchantSpring). They explored how to recover revenue lost to Amazon’s various vendor deductions and shared practical strategies to boost profitability. We’ll break down the core deduction types (chargebacks, shortage claims, price claims, co-op fees, returns), explain their impact on your bottom line, and – most importantly – outline proactive and reactive strategies for Amazon agencies and vendor managers to recover lost revenue and prevent future deductions.

Whether you manage a global brand’s Vendor Central account or are an Amazon agency professional guiding clients, this comprehensive guide will help you navigate Amazon’s complex deduction landscape. It’s time to stop leaving money on the table and start lifting your Amazon vendor profits.

The Hidden Profit Killer: Amazon Vendor Deductions

In the Amazon vendor world, “deductions” is the umbrella term for any unexpected amount Amazon subtracts from payments due to a vendor. Unlike the standard, negotiated co-op fees and marketing funds (the “known knowns” baked into your trade terms), these deductions are unplanned penalties or adjustments triggered when something goes wrong. They often hit your account long after a transaction, making them easy to overlook until they’ve piled up. For many vendors, these hidden charges are the silent profit killers that evaporate bottom-line profits.

Why does Amazon issue these deductions? The simple answer is compliance and efficiency. Amazon’s retail operations run on razor-thin timelines and strict processes. When vendors deviate from Amazon’s requirements – be it in shipping, labelling, packaging, invoicing, or data accuracy – Amazon doesn’t hesitate to charge fees or withhold payment to cover the inconvenience. From Amazon’s perspective, these fines incentivise vendors to streamline operations so Amazon’s fulfillment centers can run like clockwork. But for vendors, the financial impact can be huge. In some audited accounts, cumulative deductions amounted to 5-10% of total shipped COGS, tipping a potentially profitable account into the red. It’s crucial to understand the different types of deductions and identify where your greatest exposures lie.

Common Amazon Vendor Deductions include:

- Chargebacks – Compliance fines for not adhering to operational requirements (often labeled as “vendor chargeback fees”).

- Shortage Claims – Deductions for inventory Amazon claims it didn’t receive in full.

- Price Claims – Adjustments when invoice pricing doesn’t match the agreed terms.

- Co-op Fee Discrepancies – Overcharges beyond the agreed co-op percentages or outside valid periods.

- Returns-related Deductions – Charges related to returned or unsellable stock (in certain cases).

In the sections below, we’ll dive into each category, illustrating how they occur, how they impact profitability, and how to tackle them. Keep in mind that recovering these funds requires diligence – but as James notes, it’s well worth the effort: “If there’s one thing to take away, it’s that shortage claims are often where the biggest recovery opportunity lies.”

“Amazon Vendor Central is supremely complex, but this is where the action is. You have to cut through the noise and focus on what truly impacts profitability.”

— James Wakefield, Founder of WAKE Commerce

1. Amazon Chargebacks: Compliance Fines You Can’t Ignore

Chargebacks are perhaps the best-known type of vendor deduction – and the most frequently occurring. A chargeback (sometimes called an operational chargeback or compliance fine) is essentially a penalty Amazon charges vendors for failing to comply with predefined requirements in the purchase order and fulfillment process. Amazon has a long list of these requirements, and accordingly, there are numerous chargeback codes (a dozen or more) covering various infractions. Common examples include:

- PO On-Time/In-Full (OTIF) Violations: If you deliver products late against the promised ship window or in incomplete quantities, Amazon will fine you. Timely fulfillment is critical to their supply chain, so a late shipment triggers an “On-Time Non-Compliance” chargeback.

- Labelling Errors: Amazon mandates specific labelling (e.g. scannable barcodes, Amazon-specific shipment labels) and packaging guidelines. Missing or incorrect carton labels, unreadable barcodes, or improper carton contents (like mixed SKUs when they expected single-SKU cases) can all result in chargebacks.

- Prep and Packaging Issues: Certain products require prep like poly-bagging (for liquids, fragile items, etc.) or safety seals. If Amazon has to repackage your items (for example, bagging leaky liquid containers or repalletizing oversized cartons), they’ll charge you for that service. One example James shared was Amazon repeatedly charging a vendor for not poly-bagging a liquid product – in that case, the product was actually compliant and even had special e-commerce caps, but Amazon’s system flagged it erroneously due to a misclassification. Resolving such issues can be tedious, but it’s important to get products correctly classified to stop recurring fines.

- Unauthorised Shipping Methods or Routing: If you don’t follow Amazon’s routing instructions (for instance, you use your own carrier when Amazon required Collect shipping, or you miss a booked delivery slot), expect a chargeback. Similarly, “Ship Carrier Compliance” or “Floor-Loaded Truck” violations fall here.

- Carton and Pallet Non-Compliance: Amazon has strict rules for carton dimensions, weight, pallet stacking, etc. Sending oversized cartons, improperly shrink-wrapped pallets, or not labelling pallets properly can all incur fines.

Chargebacks tend to be high frequency and can add up fast, especially if your operations have consistent gaps. The good news is that, in many cases, chargebacks are within your control to prevent: they are Amazon’s way of telling you exactly where your supply chain or warehouse process needs improvement. The bad news: if you’re hoping to recover chargeback fees through disputes, temper your expectations. Amazon usually issues chargebacks correctly (according to their systems), and the dispute success rate is low – often these fines stick unless you have ironclad proof of Amazon’s error (which is rare). Moreover, the window to dispute chargebacks is tight (often 30 days from charge date), so most vendors miss the chance.

Best approach: Treat chargebacks as a real-time feedback mechanism to improve compliance, rather than a recoverable loss. Use the Vendor Central Operational Performance dashboard or reports to identify your top recurring chargeback types and their root causes. For example, run a report of all chargebacks in the last 6–12 months (as Paul suggests, you can export two years of chargeback data to analyse trends by type or ASIN).

Then prioritise fixing the issues: renegotiate with or change your 3PL if late deliveries persist, invest in automated labelling systems or EDI integrations to eliminate barcode errors, retrain your warehouse team on Amazon’s packaging guidelines, etc. Every chargeback prevented is money straight back to your profit. Dispute chargebacks selectively – only when you have clear evidence (e.g. a POD showing an on-time delivery that Amazon marked late). Otherwise, your time may be better spent on prevention and on the bigger fish: shortage claims.

2. Shortage Claims: The Biggest Profit Drain (and Opportunity)

If chargebacks are the loud, obvious fines, shortage claims are the silent assassins of vendor profitability. An Amazon shortage claim occurs when Amazon’s system believes that the quantity of product they received at the fulfillment centre is less than what you invoiced for on the purchase order. In plain terms, Amazon is saying: “You billed us for more units than we actually got, so we’re short-paying your invoice.” The entire difference in value is deducted straight out of your payment.

Shortage claims often catch vendors by surprise for a few reasons:

- Timing: The claim (deduction) typically appears only when the invoice is due for payment (say 60 or 90 days after shipment). By then, you might not even remember the shipment details, and the issue gets buried in accounting.

- Visibility: Amazon doesn’t make it easy to spot shortages. These claims are buried in Vendor Central’s Payments > Invoices section, and worse, Amazon hides shortage details older than 9 months from the interface. Many vendors don’t routinely reconcile every invoice against receipts, so shortages can snowball unchecked for months or even years.

- Complexity: The process to dispute shortage claims can be convoluted. It often requires pulling data from multiple reports or systems, and Amazon’s responses can be inconsistent, requiring persistence.

Despite these challenges, shortage claims represent the largest recovery opportunity for most vendors. In the webinar, James shared examples of clients where accumulated shortages equalled 5–10% of all shipped volume – amounting to hundreds of thousands in lost revenue. The good news: with thorough auditing, his team achieved about a 97% recovery rate on disputed shortage claims. In other words, in the vast majority of cases, the stock was actually delivered and Amazon ultimately acknowledged it.

So why do shortages happen, and how can you address them? Key causes include:

- Operational Mistakes: Sometimes, the vendor genuinely didn’t ship the full PO quantity (e.g. a last-minute short-ship or a picking error). If you invoiced for more than shipped, the shortage claim is legitimate. (Pro tip: If you know you short-shipped, adjust the invoice ASAP to prevent the automatic claim).

- Amazon Receiving Errors: Amazon’s massive warehouses handle millions of units, and they do make mistakes. A pallet might get misplaced, or an associate might count 8 boxes instead of 10. These errors create false shortages.

- Barcode/Label Issues: Perhaps the biggest culprit behind false shortages is labelling and data errors. If your cartons aren’t labelled correctly or the barcodes can’t be scanned, Amazon’s check-in might register fewer units. Similarly, if your Advance Shipment Notification (ASN) or EDI data is incorrect or didn’t transmit properly, Amazon’s system of record might not match what was physically delivered.

- Mixed SKU Pallets or Cases: If you send mixed products in one carton or pallet without precise labelling, it increases the chance something gets lost or miscounted. Amazon’s preference is often for solid pallets of a single SKU or at least very clear pallet content labels. Not following Amazon’s packing guidelines can induce human error at receiving.

- System Glitches: Occasionally, Amazon’s internal data reconciliation fails – especially if there were check-in delays or transfers between fulfillment centres. This is rare, but it happens.

How to tackle shortage claims: A two-pronged approach is needed – reactive recovery and proactive prevention.

Reactive – Audit and Dispute: If you haven’t already, conduct a comprehensive audit of past transactions to identify and quantify shortage claims. This means reconciling every PO invoice to what Amazon paid, for as far back as you can access data. (Note: Vendor Central’s UI shows 9 months; for older data, you may need to pull reports like the Transactional reports or get help from Amazon support or a tool). Focus on the highest-dollar POs and look for patterns (certain ASINs or dates).

Once identified, file disputes for each shortage through Vendor Central, providing any supporting evidence available. In many cases, you might not even have to upload proof – Amazon can often verify internally if stock was eventually found. The key is to be persistent and thorough. Don’t be discouraged if Amazon initially rejects a claim; escalate with additional detail if you truly believe the stock was delivered. As James noted, persistence pays off: “We have recovered about 97% of disputed shortage claims this year, indicating that Amazon did receive the stock in most cases.” Each successful dispute is money back in your pocket (often, sizable sums).

Proactive – Fix the Root Causes: Stopping shortages from occurring (or minimising them) is the long-term play. Some best practices include:

- Ensure Accurate Carton/Pallet Labelling: Use Amazon’s SSCC labels or carton IDs correctly. Place labels where they’re scannable. Consider adopting GDSN barcodes or Amazon’s Advanced Shipment Label programs that improve receiving accuracy.

- Leverage Amazon Programs: If eligible, use Pallet Ordering (PICS) or Floor Ready programs where Amazon pre-specifies pallet configurations for easier receiving. Shipping in neat, single-SKU pallets (when possible) can drastically cut down receiving errors.

- Improve ASN & EDI Reliability: Make sure your Advance Shipment Notifications are 100% accurate and transmitted promptly. If you’re on EDI, monitor that acknowledgments flow correctly. Any mismatch between what’s shipped and what’s in Amazon’s system can trigger automated shortages.

- Keep Proof of Delivery and Packing: Maintain organised records for each shipment – packing lists, BOLs, carrier delivery confirmations, photos of pallet labels – so you can quickly investigate when a shortage arises. This also helps in the dispute process if Amazon ever asks for evidence.

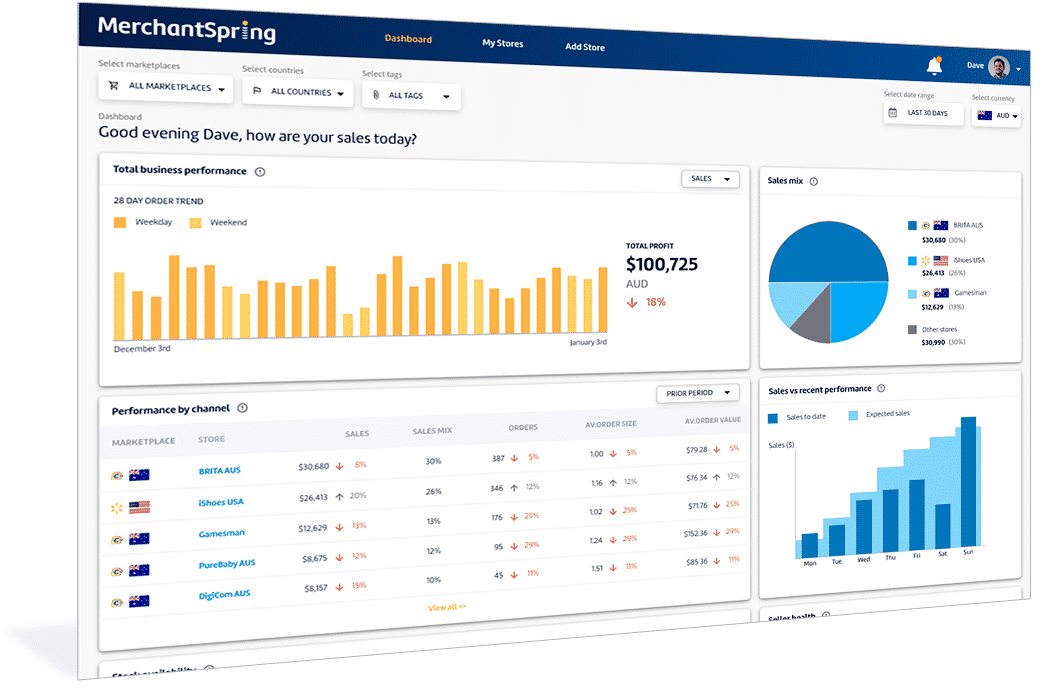

- Regular Reconciliation: Don’t wait for year-end to discover shortages. Institute a monthly or quarterly reconciliation process. By catching issues early (within a month or two of delivery), you increase your chances of successful disputes, and you can address systemic problems faster. Modern vendor analytics tools or dashboards (like a Vendor P&L report) can alert you to payment discrepancies automatically, so consider using software or building a spreadsheet model to flag under-payments.

Shortage claims can be frustrating, but given their potentially huge impact, they deserve priority attention. Every unit that Amazon misplaced or miscounted is your revenue sitting on a warehouse shelf – go get it!

3. Price Claims: When Invoices and Agreements Don’t Match

Another deduction type that vendors occasionally encounter is the price claim. A price claim happens when Amazon believes the invoice price you charged doesn’t align with the agreed cost in their system. For instance, if your purchase order for ASIN X was at $10/unit but your invoice came in at $11/unit, Amazon will short-pay the difference. This can also occur due to currency discrepancies, unexpected freight or handling charges on the invoice, or if the case pack quantity on the PO differs from what was invoiced.

In practice, price claims tend to be less frequent and usually smaller in dollar value than other deductions. They often arise from data mismatches – say, your team updated the product cost in one system but not in Vendor Central, or a typo caused a 100-unit case to be invoiced as 10 units at ten times the price. The good news is that price claims are usually straightforward to dispute or resolve: they’re purely about documentation. Amazon typically allows you to provide the corrected invoice or PO info to get reimbursed, and since these are black-and-white errors, resolution rates are high. The bad news is that price claims signal something off in your internal processes (pricing maintenance, catalogue data accuracy, etc.), so you’ll want to fix those to avoid ongoing issues.

How to manage price claims: First, ensure your vendor agreements and catalogue data are up-to-date. Whenever you negotiate cost changes (e.g., during Amazon’s annual vendor negotiation), double-check that Vendor Central reflects the new terms before you ship against them. Second, train your accounting team to double-check invoices against POs for consistency in unit cost, currency, and quantities. If you do get a price claim deduction, pull up the relevant PO and vendor agreement to identify the discrepancy, then open a case with Amazon with the evidence. In many cases, simply acknowledging the error and correcting the documentation will lead Amazon to reimburse the difference. To prevent future issues, maintain a clear pricing history file – a record of all Amazon cost agreements over time – especially if you sell on multiple Amazon locales or via different vendor codes.

4. Co-Op Fee Discrepancies: Mind the Agreements

Every Amazon vendor is familiar with co-op fees (or contra-COGS agreements): these are the agreed allowances and discounts Amazon takes off each invoice, often negotiated annually. They include things like damage allowances, marketing development funds (MDF), early pay discounts, freight allowances, Amazon Vendor Services (AVS) fees, and others. These are intended to be predictable – e.g., you know Amazon will deduct 10% off every invoice as a marketing co-op fee, as per your vendor terms.

However, errors can occur here too, resulting in co-op discrepancies that cost you extra margin. Examples:

- Amazon deducts a co-op fee at a higher percentage than agreed, perhaps due to a data entry mistake on their side.

- A fee that was supposed to expire (say, a seasonal promotional allowance) continues to be deducted beyond its valid period.

- Amazon applies a fee twice or charges a fee that wasn’t agreed upon for that product/category.

- Timing issues: e.g., Amazon switches to a new damage allowance rate but applies it retroactively to invoices from the old period.

Co-op discrepancies are notoriously hard to detect because they’re often small percentages spread across many invoices and product lines. It’s like finding a needle in a haystack – you’d have to reconcile every single invoice line item against the agreed terms. Many vendors simply trust Amazon’s calculations, which is why these errors can quietly siphon off 1-2% of revenue without notice.

If you suspect co-op overcharges, you’ll likely need to conduct a manual audit or use a specialised tool. Gather all your active agreements (they’re available in Vendor Central’s Agreements section) and note the terms (e.g., “5% damage allowance valid Jan–Dec 2025 on all products”). Then pull a report of all deductions taken (the remittance reports or a Vendor deduction report might help) and filter for those co-op codes. Compare the effective rates to your expectations. Any discrepancies should be compiled and raised to Amazon. In disputes, provide the contract or email evidence of the correct terms. Amazon’s vendor support might take time to verify, but they will reimburse true overcharges, especially if it’s their error applying an outdated agreement.

Bottom line: While co-op errors aren’t as headline-grabbing as chargebacks or shortages, they’re worth checking periodically – perhaps quarterly or at least after each major vendor term negotiation – to ensure Amazon is taking only what was agreed. An unaddressed 2% over-deduction on co-op could be significant money over the course of a year.

5. Returns and Other Deductions: The Unusual Suspects

Beyond the main categories above, be aware of a few other deduction scenarios:

- Returns & Unsellable Merchandise: Amazon may return unsold inventory or defective items to the vendor (especially for consignment or overstock arrangements). Generally, if the return is due to Amazon’s issue (e.g. they over-ordered or their warehouse damaged the goods), Amazon should not penalise you. However, there have been cases where vendors receive large volumes of returned stock in poor condition, effectively eating the cost.

If Amazon charged any fees for those returns (or deducted reimbursements improperly), you should dispute them, citing Amazon’s own vendor policies on returns in sellable condition. These situations are case-by-case, but don’t hesitate to push back if Amazon didn’t follow the agreed terms for returns – the onus is on them to adhere to return allowances or defective policies. - Provision for Receivables (PFR): This is an accounting reserve Amazon might hold as a deduction for potential future claims. It’s somewhat rare and typically appears on remittance statements. If you see a “Provision” deduction, ask Amazon for clarification – it might be a placeholder that eventually should be released or adjusted.

- Invoice Adjustments for Promotions: If you participate in Amazon-funded promotions or deal events, sometimes Amazon issues a debit (deduction) to fund the promo discount. These should be expected (they usually correlate with an agreement or a campaign). Always confirm that any such deduction matches your records of agreed promo funding.

- Damaged or Lost Inventory (Warehouse Damages): Occasionally, Amazon might deduct for inventory they claim was damaged in their fulfillment centre beyond normal allowance. This typically should be covered by the damage allowance percentage you already give them. If something doesn’t add up (e.g. a sudden large deduction for “excessive damage”), raise it with Amazon – you might recover it if it wasn’t per contract.

While these “other” deductions are less common, they underscore an important point: stay vigilant on all fronts. Any time money moves in Vendor Central that isn’t simply paying your invoice in full, you should investigate it. It could be a valid charge, or it could be an error that you’re entitled to get back.

Strategies to Recover and Prevent Deductions

At this point, it’s clear that managing Amazon vendor deductions requires both defensive (recover what’s yours) and offensive (change processes to avoid future hits) strategies. Here’s how to approach it like a pro:

A. Recovering Lost Revenue: Deduction Auditing and Disputes

The first step is to quantify the problem. If you haven’t recently, perform a deduction audit for your Amazon vendor account:

- Pull Reports: Download at least the last 6–12 months of invoices and payments from Vendor Central. Use the Payments -> Transactions or Dispute Management reports. If possible, go back 2–3 years by stitching together data (some vendors export monthly reports or use tools to archive transactions).

- Reconcile Payments: For each invoice, check the amount Amazon paid versus what you invoiced. Any short payments mean a deduction occurred. Categorise those by type (they usually have a code or description like shortage, chargeback, etc.).

- Identify High-Impact Areas: Rank the deduction types by total dollar impact. You might find, for example, $50k lost to “Shortage Claims” in the last year, $10k to “Chargebacks”, etc. This helps prioritise where recovery efforts yield the most return.

- Drill Down: Within the top categories, look for patterns: Is a particular ASIN or product category often shorted or fined? Is a certain warehouse or time of year prone to issues? This investigative work will guide your corrective actions later.

Once you have a clear picture, it’s time to dispute intelligently:

- Organise Your Cases: Don’t shotgun-blast Amazon with dozens of random disputes. Instead, group related issues. For example, if 20 different POs each had a shortage of the same ASIN, consider raising a consolidated case (or referencing previous case IDs) to show the pattern.

- Provide Evidence When Available: While James noted that many shortage disputes get resolved without additional documents, it can speed up resolution to include proof if you have it handy. This could be a signed Proof of Delivery from the carrier, warehouse receiving logs on your side, or photos of the shipment. For chargebacks, evidence is often required to overturn (e.g. a compliance certificate if Amazon said your product wasn’t prepped correctly, but it was).

- Leverage Vendor Support and Vendor Managers: If you have a Vendor Manager (VM) or Amazon retail contact, loop them in for large disputes. They can sometimes internally escalate payment issues. Likewise, if a dispute gets wrongly denied via the normal support channel, don’t be afraid to re-open it or even raise it during QBR meetings with Amazon, emphasising the financial impact.

- Stay Persistent and Track: Make an internal log of all disputes filed, including date, reference number, and status. Amazon’s responses can be slow and sometimes incomplete. Follow up periodically. The general rule: don’t give up until you’ve exhausted all reasonable avenues. You’re entitled to that money if you can show Amazon received what it paid for or made an error.

One more tip: act within allowed timeframes. Amazon has recently tightened some dispute windows. For example, there may be a limit (e.g. 9-12 months) for disputing shortage claims after the invoice date. If you have older unresolved deductions, try nonetheless – you might still succeed on older items via manual escalation – but prioritise recent cases that are well within the window.

B. Preventing Future Deductions: Best Practices for Vendor Operations

Recovery is only half the battle; the other half is making sure these profit leaks don’t continue. Adopting these best practices will help minimise future chargebacks and claims:

- Know and Follow Amazon’s Requirements: It sounds basic, but ensure you have the latest Amazon Vendor manuals and routing guidelines. Amazon occasionally updates its compliance rules (for example, they might adjust labelling requirements or shipping windows). An up-to-date SLA (Service Level Agreement) awareness can save you from “unknown” fines. Train your operations staff on these specifics and consider creating a checklist for every PO shipment (e.g., labels printed and placed correctly? pallet height within limit? shipped within window? ASN sent?).

- Streamline Warehouse Processes: If late shipments or packaging errors are plaguing you, address your internal workflow. Buffer more time for order processing to hit ship windows. Use technology to reduce manual errors – for instance, scanner systems that verify you’re picking the right quantities, or software that flags if a case label hasn’t been generated for a carton. Sometimes partnering with a 3PL experienced in Amazon Vendor compliance can be worth it if your current logistics can’t meet requirements.

- Adopt a Chargeback Management System: For vendors with high volume, investing in a chargeback monitoring system (whether a feature in your vendor analytics platform or a third-party solution) can pay off. These systems can alert you the moment a new chargeback or deduction hits, categorise it, and even auto-suggest reasons. Early awareness means you can respond or dispute faster. Even a simple internal dashboard using Vendor Central’s API or reports can give you a real-time view of chargebacks and shortages, so nothing slips through.

- Improve Communication with Amazon: James emphasises plain-speaking, proactive communication. If you know a shipment might be late or an issue occurred (e.g., a production delay means you can’t fulfill 100% of a PO), inform Amazon Retail or Vendor Support in advance. They might not waive a chargeback, but documenting issues can help your case later. Additionally, maintain a good relationship with your Vendor Manager; they can sometimes grant exceptions or at least help prioritise fixing systemic problems (like repeated false chargebacks due to an Amazon error).

- Regular Financial Reconciliation: Incorporate deduction reviews into your routine business cadence. For example, every month, have your finance team review the latest remittance and identify any new deductions. Even a quick scan can catch an unfamiliar charge. This way, you address issues while they’re fresh (and within dispute windows) rather than letting them accumulate.

- Seek Expert Help When Needed: If all of this sounds overwhelming, that’s because Vendor Central can be overwhelming. Don’t hesitate to consult experts or use software tools specialised in Amazon deduction management. The webinar speaker, James Wakefield, for instance, runs an agency that offers auditing and recovery services (as do some SaaS tools in the market). If you’re an Amazon agency managing multiple clients, you might consider implementing a standard deduction audit service – it’s a valuable add-on for clients and directly improves their P&L. Just ensure any partner or tool you use is reputable (and not a direct competitor to your services). The goal is simply to make sure you’re not leaving easy money with Amazon due to a lack of bandwidth or expertise.

By putting these preventive measures in place, you’ll gradually see the volume of new deductions fall – fewer chargeback emails coming in, fewer shortages at invoicing – which means higher net receipts and healthier profit margins for your Amazon business. As one of our speakers put it, it’s about “cutting through the complexity” and focusing on what you can control to maximise profitability.

Conclusion: Turn Deductions Management into Profit Enhancement

Amazon’s vendor ecosystem may feel complex and unforgiving, but it rewards those who bring diligence and data-driven strategy to the table. By fully understanding chargebacks, shortage claims, and other deductions, you can turn what is often seen as a cost of doing business with Amazon into a source of recovered revenue and continuous improvement. In effect, managing deductions isn’t just about clawing back lost dollars – it’s about refining your operations to prevent future losses, thereby boosting your long-term profitability on the channel that matters most.

For Amazon agency professionals, this is a prime opportunity to demonstrate value to clients: proactively monitoring and optimising against deductions can directly improve a vendor’s bottom line by several percentage points. It’s not glamorous, but it is effective. As Amazon continues to tighten policies and automate compliance, vendors who stay on top of these fines and claims will outpace those who ignore them.

In summary, make deduction management a habit. Schedule regular check-ups on your Vendor Central account health, invest in the right tools or partnerships, and keep educating your team on Amazon’s requirements. The result will be fewer surprises in your financials and more cash that stays in your business.

If you found these insights useful, consider watching the full webinar replay for a deeper dive and real-world examples. And don’t leave without action – perform a quick audit of your last month’s Amazon invoices to see if any unexpected deductions pop out. You might be sitting on a goldmine of recoverable profit.

Stay Informed: Subscribe to our Marketplace Masters newsletter for more expert insights and strategies to master Amazon Vendor Central. Don’t let Amazon’s complexity stand in the way of your profits – let’s conquer it together!

Add a Comment