3 Common E-commerce Accounting Mistakes and How to Avoid Them

With increased online sales, proper accounting, and financial management have become more crucial than ever for e-commerce business owners. The fact is, accounting for e-commerce stores takes a lot of work. It’s convoluted and complex, and many entrepreneurs in the e-commerce space end up making the same accounting mistakes, which can lead to significant financial issues down the line.

The A2X team works with many expert e-commerce accountants, and over the years, they've identified the three most common accounting mistakes that e-commerce businesses make. Read on to learn what those mistakes are and hear practical tips on avoiding them, better managing your finances, and achieving long-term financial success.

Cash vs. accrual accounting (and modified cash)

We compiled this list after years of speaking with expert e-commerce accountants who have seen how difficult it can be for e-commerce business owners to self-manage their accounting and who have found themselves correcting the same errors time and time again.

The crux of some of these mistakes is business owners using the wrong accounting method. Before getting into these mistakes, let's do a quick refresher on the differences between cash-basis and accrual-basis accounting.

- Cash accounting records transactions when money changes hands

- Accrual accounting records transactions as they occur

- Modified cash is a hybrid of the two methods, allowing you to handle your operating expense transactions using the cash basis and revenue and COGS using the accrual basis

In general, accrual or modified cash accounting is regarded as the best method because they provide greater detail and allow for easier and more accurate forecasting. The GAAP also requires accrual accounting for larger businesses.

Why does your method matter?

E-commerce accounting is complex because transactions occur via your sales channel—Amazon, Shopify, etc.—rather than directly in your bank. And they need to be tracked consistently month-to-month. Unfortunately, this is not always easy because the sales channels pay sellers in batches.

For example, Amazon pays sellers in batch deposits every two weeks. But, that net deposit isn’t just sales, it’s your sales minus any extra costs and fees. Additionally, your settlement could include sales tax, which you do not get to keep and needs to be remitted to the government.

Finally, some sellers account for their COGS (Cost of Goods Sold) as they purchase products rather than at the time of sale. This can result in skewed profit margins that directly affect all business areas.

To avoid these common mistakes, you must use the correct accounting method, either accrual or modified cash accounting.

3 common e-commerce accounting mistakes

1. Recording net deposits as income

Recording net deposits as income is the number one mistake the e-commerce accounting experts working with A2X see. Net deposits are made up of many different transaction types, so treating the deposit as income gives you a false sense of your business’s overall financial state.

Why is this mistake made?

E-commerce business owners receive batch deposits into their bank accounts in the form of Amazon settlements, Shopify payouts, etc. it’s tempting to assume that this money is all income derived from sales transactions. In reality, more than 400 different transaction types can go through a merchant account, and that deposit could include any number.

Why is this bad?

Failing to account for all those different transaction types can result in a business paying additional costs that were completely avoidable with correct accounting. For example, if you report your net deposit as income, you could push your margins by 50% or more, resulting in serious tax implications and inaccurate bookkeeping.

Not identifying the fees your business is subject to in your books can lead to difficulty in determining whether your sales are increasing or decreasing or whether the total fee value is simply changing.

Recording net deposits as income will also lead to difficulty in dividing the amount into the appropriate pay periods. For example, Amazon settlements are made every two weeks, so there’s a high chance that settlements will contain income earned across two months. If you’re not recording your deposits and transaction types correctly, it will be difficult to accurately account for what income was earned and when, leading to messy, inaccurate books.

For owners eventually looking to sell their company or get investment or funding, inaccurate accounting for your income can become a massive headache. Potential buyers and investors will want to see accurate books to ascertain the actual value of your business. If your books are messy and inaccurate, the best-case scenario would be a stressful scramble to clean them up quickly. Meanwhile, in a worst-case scenario, buyers or investors could walk away from what they see as a chaotic situation.

2. Incorrect handling of COGS

Properly accounting for the Cost of Goods Sold (COGS) is crucial for e-commerce businesses to calculate their profit margins accurately. Failing to account for COGS correctly can cause significant problems for the business.

Why is this mistake made?

COGS is often one of the biggest expenses for e-commerce sellers, as it represents the direct costs of producing or acquiring the products the business sells. Using the cash accounting method can make it easy to record the cost of products incorrectly.

When purchased, inventory should be recorded as an asset rather than an expense, accurately reflecting the total value of the business and its current profit margins. This is done using the accrual or modified cash methods of accounting and means that inventory only becomes COGS when it's sold, which is more accurate to the reality of the business and its operations.

However, suppose a business is using the cash method of accounting. In that case, inventory purchases are treated as COGS when the company pays for them rather than when the inventory is sold.

Why is this bad?

In short, proper accounting for COGS is critical for e-commerce businesses to remain financially stable and make informed decisions that lead to long-term success.

Incorrectly accounting for COGS can result in inaccurate profit margin calculations, negatively impacting various business areas. For example, not knowing which SKUs are performing well can make investing time and money in products that generate the most returns difficult.

Additionally, without accurate profit margin calculations, pricing judgments become guesses, potentially causing the business to miss out on opportunities to increase margins in the long term.

And, without a good line of sight over SKU performance, this could result in either over or under-ordering stock. Naturally, this can lead to problems with customer satisfaction and either high storage fees or wasted space.

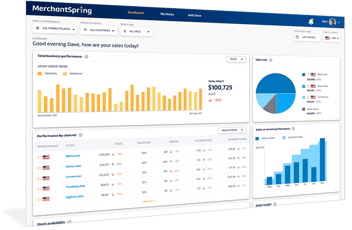

To overcome these issues, COGS should be accounted for correctly. You can also double down on these efforts by using a reporting suite like MerchantSpring to help shed light on SKU performance and profitability. The bonus of using MerchantSpring alongside your traditional accounting software is that your finances stay neat, tidy, and accurate—perfect for compliance—while your reporting suite can really drill down and let you analyze your SKU's performance at a very detailed level in a way accounting software isn't designed to do.

3. Recording sales tax as income

Another common mistake businesses make is adding sales tax to the profit and loss sheet instead of the balance sheet. Sales tax is a liability collected on the government's behalf, not revenue earned by the company, and therefore it should be recorded separately.

Why is this mistake made?

This mistake is especially common when using the cash accounting method because this method recognizes revenue when cash is received, and sales tax is often collected at the time of sale. So, if sales tax is not recorded correctly as a liability, it can be mistakenly recorded as income when net deposits are recorded as sales revenue.

Why is this bad?

If sales tax is added to the profit and loss sheet, it could be a costly mistake as it can inflate the reported revenue and profitability of the company. This can lead to inaccurate financial statements and mislead investors, creditors, and other stakeholders.

Aside from misrepresenting a company’s revenue and profitability, this mistake is also seen as non-compliance by state and federal agencies, which could lead to hefty fines. If your business has been non-compliant for years, this could be very expensive, and you’ll have to pay out of pocket.

Avoiding these mistakes with automation or experts

If your business is making any of these mistakes—or if you just want to ensure your books are as neat, tidy, and accurate as possible—you need to step up your accounting game by hiring an e-commerce accountant or using an accounting automation app like A2X.

A2X connects your e-commerce platforms with your accounting software. It takes the necessary data from your sales channel, breaks it into neat, accurate summaries, and passes it onto your accounting software, such as QuickBooks or Xero. This way, you can be sure that your net deposits are recorded correctly, and you won't be overstating your income.

A2X does all of this automatically and with total accuracy, helping you avoid the mistakes mentioned in this blog. An additional bonus is that A2X reduces an hours-long, error-prone process to just minutes, giving you more time to spend on other tasks.

Check out how James Dihardjo discussed How Keeping Your Financial Reports Separate Leads to More Opportunities for Growth and Profitability

–

GUEST AUTHOR

Allanah Faherty is the Marketing Content Manager of A2X, a gold standard in e-commerce accounting for Shopify, Amazon, BigCommerce, eBay, Etsy, and Walmart sellers. You can connect with Allanah via Linkedin.

Add a Comment