Amazon Expansion in LATAM: Opportunities, Risks & Strategy

Overview

Amazon’s established markets in the U.S. and Europe are increasingly competitive and saturated. Forward-thinking agencies are now looking to Latin America (LATAM) as the next e-commerce frontier. In fact, Latin America’s e-commerce sector surged in the wake of COVID-19 and is projected to keep growing rapidly(sell.amazon.com). For Amazon brand owners and the agencies that support them, this presents a chance to ride a new wave of growth. But how do you break into these markets successfully? What challenges should you be prepared to navigate?

In this article, we synthesise expert insights from an episode of the Marketplace Masters webinar on expanding into LATAM. The session was hosted by Paul Sonneveld (Co-Founder & CEO of MerchantSpring) and featured Vincenzo Toscano (Founder & CEO of Ecomcy, an agency specialising in Amazon & Walmart expansion). Vincenzo has firsthand experience scaling brands across Amazon Mexico and Amazon Brazil, and his guidance can help Amazon agency professionals chart a clear path into Latin America. We’ve expanded on the discussion with additional research and strategic tips to create a practical blueprint for LATAM expansion. Let’s dive into the core opportunities, strategies, and pitfalls – and how to position your clients for success in this dynamic region.

Why LATAM and Why Now: A “Blue Ocean” Opportunity

Latin America today offers something increasingly rare in e-commerce: untapped growth potential. Unlike the mature Amazon marketplaces in North America and Europe, many LATAM markets are still in their infancy when it comes to online shopping. “The market is so primitive compared to what we’re used to in the US and Europe,” Vincenzo explains, that a savvy seller can enter now and gain a huge advantage with relatively little competition. In his words,

“Latin America is a blue ocean compared to the US or Europe. The market is still so far behind that if you bring the expertise you have from those competitive markets, you can gain a huge advantage.” – Vincenzo Toscano

Several factors make 2024–2025 an ideal window to expand into the LATAM Amazon marketplaces:

- Post-COVID E-Commerce Boom: The pandemic accelerated online shopping adoption in LATAM. Consumers who traditionally preferred brick-and-mortar retail were forced to buy online, often for the first time. In countries like Mexico, the percentage of the population buying online jumped significantly and is still climbing (sell.amazon.com). This forced behaviour change also led to a spike in new bank accounts and debit/credit card usage, addressing a long-time barrier to e-commerce in the region. Many Latin Americans who once lacked access to online payments (or feared fraud) are now active e-commerce shoppers.

- Infrastructure & Trust Improvements: Major players such as Amazon and Mercado Libre have invested heavily in logistics and customer protection. Faster delivery options (e.g. Amazon Prime, Mercado Libre’s “Full” fulfillment) and guarantees against fraud have begun to erase the old stigma that buying online might mean getting scammed. As Vincenzo notes, consumer trust in e-commerce platforms is much higher now than it was pre-2020, making it easier for new brands to win purchases.

- Early Mover Advantage: Most categories in LATAM Amazon sites are far less competitive than their U.S. or European equivalents. It’s common to find entire product niches with only a few serious sellers. A brand that’s battle-tested in a hyper-competitive market can often enter a Latin American market and quickly become a category leader. Being among the first movers means you can establish your client’s brand and reviews before the inevitable influx of other global sellers (notably the wave of Chinese sellers that have already begun targeting Mexico). Vincenzo likens the opportunity to getting into the U.S. or EU markets 5–10 years ago – and cautions that this window will close in a few years. “If you don’t take advantage now while it’s still early, five years from now you’ll regret not jumping in when you had the chance,” he says, emphasising the urgency.

- Amazon’s Investment in LATAM: Amazon has made Latin America a strategic priority. It launched Amazon Mexico in 2015 and Brazil in 2017, and it’s gearing up for new marketplaces in Colombia and Chile (expected around 2025). The company’s LATAM expansion teams are actively courting established U.S. and European brands to launch in these markets (Mexico: Your Launchpad for LATAM Amazon Expansion). Early adopters may benefit from special incentives – for example, some sellers have seen Amazon waive referral fees or offer promotional support to encourage big product portfolios to launch on (Amazon.com.mx)(Mexico: Your Launchpad for LATAM Amazon Expansion). In short, Amazon wants quality selection in LATAM and is willing to help new entrants. That support won’t last forever.

In sum, Latin America represents a rare growth frontier for Amazon agencies – but success isn’t guaranteed. To capture the LATAM opportunity, you need a smart market entry strategy, starting with picking the right initial market.

Choosing Your Entry Market: Mexico First, Brazil with Caution

“Latin America” is not a monolith – it’s a diverse region of over 20 countries, and Amazon’s presence varies across them. As an agency planning an expansion, you’ll need to prioritise which country to tackle first. According to Vincenzo (and echoed by many experts), Mexico is the clear first stop for Amazon expansion in LATAM, followed by a more strategic look at Brazil and beyond.

Why Mexico?

✅ Market Size & Growth: Mexico is Latin America’s second-largest economy and has embraced e-commerce faster than any of its neighbors. Amazon Mexico (Amazon.com.mx) has exploded in popularity – by some measures, Amazon now even outsells Mercado Libre in Mexico (sell.amazon.com), which is a major turning point. With over 80 million internet users and a young, mobile-savvy population, Mexico’s online consumer base is growing rapidly. The country is forecasted to have 118+ million e-commerce users by 2029 (sell.amazon.com). For Amazon sellers, this translates to a market that could be ~5-10% of the size of the U.S. Amazon market for many product categories (some brands report roughly 5% of their US sales volume when they launch in Mexico, though high-performers can exceed that (Mexico: Your Launchpad for LATAM Amazon Expansion)).

✅ Logistical Proximity: Mexico’s proximity to the U.S. makes operations simpler. If your client already distributes from U.S. warehouses or 3PLs, getting inventory to Amazon FBA centres in Mexico is relatively straightforward (ground shipping across the border or short-haul ocean freight). Delivery times to Mexican consumers can be kept low with FBA, and cross-border shipping costs are manageable. Additionally, many U.S.-based brands find it easier to navigate Mexican business culture and regulations compared to more distant locales.

✅ Lower Barriers to Entry: Unlike some other LATAM countries, Mexico doesn’t impose prohibitive import barriers for most goods. Import taxes and duties exist but are generally reasonable (with some exceptions like high tariffs on textiles to curb ultra-cheap Chinese imports (Mexico: Your Launchpad for LATAM Amazon Expansion)). It is also easier to register for tax IDs and comply with Amazon’s requirements in Mexico than, say, Brazil. Vincenzo points out that Brazil, while a huge market, has “a lot of bureaucracy to enter”. Brazil levies steep import taxes that can exceed 60-100% on common consumer goods, especially those manufactured outside Mercosur trade countries. Mexico, by contrast, has trade agreements (like USMCA) that facilitate U.S.-made or China-made goods entering with lower duties. The comparatively smoother import process makes Mexico a logical pilot market before tackling others.

✅ Amazon and Mercado Libre Presence: Mexico is one of the few LATAM countries where Amazon and Mercado Libre both have strong operations. This competition benefits sellers – both marketplaces are investing in better seller tools, advertising options, and fulfillment infrastructure in Mexico. As an agency, you can potentially launch your client on two major platforms (Amazon Mexico and Mercado Libre) to maximise reach. But even if you focus on Amazon, the overall e-commerce “pie” is growing quickly in Mexico, and Amazon’s brand is trusted by a large share of consumers.

For these reasons, our experts recommend launching in Amazon Mexico first. Once you gain traction there, you can consider expanding to Brazil and upcoming Amazon markets like Colombia:

- Brazil: Amazon Brazil (Amazon.com.br) is Latin America’s largest e-commerce market by user count, and cannot be ignored. However, to succeed there, you often need a localised approach (many successful sellers manufacture or stock products within Brazil to avoid import taxes and delays). Brazil’s government policies favour domestic production – foreign brands shipping from China or the US face heavy taxation and red tape. If your client has the resources, establishing a local entity or partnering with a Brazilian distributor can unlock the market’s potential. But if not, be cautious: don’t jump into Brazil prematurely. Many sellers pilot their top products in Mexico first, then expand to Brazil once they have proof of concept and a plan for the bureaucracy. (Notably, Brazil is part of the Mercosur trade bloc – if you can produce your product in a Mercosur country like Mexico or Colombia, you can import into Brazil with fewer taxes. This is a long-term consideration for those looking to scale in the region.)

- Emerging Markets (Colombia, Chile, etc.): Amazon has announced intentions to launch marketplaces in Colombia and Chile, two countries with growing e-commerce scenes. At the time of the webinar, these were expected around 2024–2025, though timelines can shift. Smart agencies can start preparing by researching demand trends now. Vincenzo suggests using tools like Google Trends or local market research to gauge interest for your products in those countries before Amazon opens there. If you identify high-demand keywords or underserved niches via search data, you could position your client to be first to market when Amazon Colombia or Chile go live. In the meantime, focus on Mexico (and perhaps list products for Colombian or Chilean customers via Amazon’s NARF program, discussed below, or on Mercado Libre’s platforms, which already serve those countries).

- Other LATAM Countries: Outside of Amazon’s own expansion, remember that Mercado Libre covers most of Latin America (it’s the #1 marketplace in countries like Argentina, Colombia, Chile, Peru, etc., where Amazon hasn’t established a retail site yet). If your client’s brand resonates in those markets, you could consider Mercado Libre as a channel. That said, each additional country will add complexity. Many agencies choose to nail Mexico (and maybe Brazil) first, since success there can create a template and cash flow to fuel further expansion.

Key Takeaway: Start with Amazon Mexico to get early wins in LATAM. Treat Brazil as a second phase unless your client already has a footprint there. Keep an eye on new Amazon launches in the region and have a game plan to capitalise on them early. By sequencing your expansion, you can manage risk and the learning curve step by step.

Amazon vs. Mercado Libre: Navigating the E-Commerce Landscape

Any discussion of Latin American expansion would be incomplete without addressing Mercado Libre, often dubbed “the Amazon of Latin America.” Mercado Libre (sometimes written MercadoLibre) is the dominant online marketplace in many LATAM countries and predates Amazon’s local presence. How does it factor into your expansion strategy for Amazon brands?

Mercado Libre’s Dominance: Mercado Libre has been the e-commerce leader in LATAM for over a decade. In markets like Argentina, Chile, and Colombia, it’s the go-to platform for online shopping. Even in Mexico and Brazil, where Amazon operates, Mercado Libre still holds a substantial market share (though Amazon is catching up fast in those two). Mercado Libre built its reputation as a C2C and B2C marketplace where anyone could list items (similar to eBay). As Vincenzo describes, it

“behaves as a two-front marketplace – like an eBay or Facebook Marketplace for used items and flips, and also trying to be a platform for brands.”

This means the product mix on Mercado Libre can be very broad (new products, used goods, refurbishments, etc.), and the overall customer experience is less streamlined than Amazon’s.

Amazon’s Differentiation: Amazon, on the other hand, entered LATAM with its familiar model of a more curated, standardised shopping experience (especially via FBA and Prime). Amazon’s customer experience tends to be superior – efficient logistics, strong buyer protections, and robust brand tools (A+ content, brand registry, etc.). Consumers have noticed; for example, many Mexican shoppers now prefer Amazon for higher-value or premium purchases, while Mercado Libre might be seen as a place for bargains or hard-to-find items.

Strategic Consideration for Agencies: For an established brand (with quality, branded products), Amazon is often the better primary channel in LATAM. Amazon allows you to maintain a premium feel – you can create Spanish-language A+ content, brand stores, and run Amazon Ads to target relevant keywords. You also have protection against counterfeiters through Amazon’s brand registry programs, which Mercado Libre lacks to the same degree. Vincenzo points out that Mercado Libre can be like the “Wild West” for brands: short character limits for listings, minimal branding capabilities, no true PPC keyword bidding (Mercado Libre’s ad system is more of an automated promotion tool), and historically a higher incidence of counterfeits or unauthorised sellers.

That said, Mercado Libre should not be ignored. If your client’s product is in a mid-price or budget category, Mercado Libre might drive significant volume – many LATAM consumers browse both platforms and will buy from whichever offers the best deal or convenience. Additionally, Mercado Libre has been improving its services, with the MercadoLibre Full fulfillment service (their version of FBA) enabling fast shipping and the Mercado Pago payment system offering financing options to shoppers. Some brands successfully use both Amazon and Mercado Libre to cover the market: for example, they might position their premium product line on Amazon and a value line on Mercado Libre, or synchronise inventory to whichever platform a customer prefers.

For an Amazon-focused agency, a reasonable approach is: launch on Amazon first, get the operation running smoothly, then consider Mercado Libre as a parallel expansion for additional reach. If you do list on Mercado Libre, be prepared for differences:

- You will need separate account management (it’s a completely separate platform).

- Content will need to be trimmed down (simpler titles, fewer details).

- Customer service expectations might differ (buyers often communicate via Mercado Libre’s messaging).

- Pricing strategy might need adjustment – Mercado Libre shoppers are highly price-sensitive, and many compare prices with Amazon.

In Mexico and Brazil, Amazon’s growth means you can succeed by focusing only on Amazon. But in Spanish-speaking South America (Colombia, Chile, Argentina, etc.), until Amazon launches, Mercado Libre is your primary option. The bottom line: know where your client’s customers are shopping. Use local market research to determine if Mercado Libre is necessary to meet your sales goals, and plan resources accordingly if you venture there.

(Insight: If you partner with a local 3PL in Mexico, you can often fulfill both Amazon FBA and Mercado Libre from the same inventory pool. Mercado Libre Full can pick up inventory from your 3PL, allowing one stock to serve both channels – a tactic that can maximize efficiency.)

Laying the Groundwork: Compliance, Logistics, and Market Research

Entering a new country requires meticulous preparation. As Vincenzo emphasises, success in LATAM isn’t as simple as “flip a switch” on your Seller Central. To set your client up for a smooth launch, you must do homework in three key areas: market demand validation, economics & compliance, and logistics setup.

- Validate Market Demand and Fit

Before sending a single unit of inventory, conduct thorough market research for each target country. Don’t assume that a bestseller in the U.S. or UK will automatically be popular in Mexico or Brazil. Tastes and needs differ by culture and region. Leverage tools like Amazon’s Brand Analytics and Product Opportunity Explorer (available in Seller Central) to gauge search volume and top products for your category in Amazon Mexico or Brazil. Third-party tools (Helium 10, Jungle Scout, etc.) also offer research for Amazon Mexico – use them to check how competitive the space is, what the estimated sales are for top sellers, and whether local brands dominate the category.

Crucially, look at keywords in Spanish (or Portuguese for Brazil). Consumers might describe the product differently. For example, a product called “stroller” in the US might commonly be searched as “carriola para bebé” in Mexico. Ensure there is sufficient search volume around the core keywords your product addresses. If the volume is low or non-existent, that’s a red flag that the product may not be in demand (or the need is solved by a different kind of product in that culture). Also, check for any cultural or climate factors: e.g. winter gear will have a much smaller market in tropical countries; certain dietary supplements or gadgets might not resonate due to different habits. Only proceed once you have data-backed confirmation that there’s real demand and room for your product in the market (Mexico: Your Launchpad for LATAM Amazon Expansion). It’s much better to discover potential issues now than after you’ve shipped inventory.

- Crunch the Numbers (Taxes, Duties, Pricing)

Latin America can present new cost variables that agencies might not encounter in domestic markets. Start by mapping out all the costs involved in delivering the product to customers in-country:

- Shipping & Freight: What will it cost per unit to ship goods from your current warehouse or manufacturer to the destination country? Fortunately, shipping to Mexico can be relatively affordable via ground transport from the U.S. or sea from China. Still, include these costs in your pricing model.

- Import Duties and Tariffs: Every product has an HS code, which determines import duty in the target country. Use Amazon’s own Compliance Reference Tool or consult a customs broker to find the exact duty % for your product in Mexico or Brazil. For instance, Mexico recently imposed a 35% import tariff on textiles to combat ultra-cheap fast fashion imports – a huge added cost for apparel sellers. Make sure such duties won’t erase your margin. If they do, you might need to consider sourcing or manufacturing in-region to mitigate them. Brazil’s import taxes are notoriously high; many products effectively double in cost after duties, which is why local production or assembly is often favoured.

- VAT/GST: Mexico has a 16% VAT, and Amazon Mexico will expect you to have a local tax registration (RFC) to remit VAT on sales. Brazil has its complex ICMS and IPI taxes. Work with a local tax advisor to understand the tax obligations and register for the necessary tax ID before you launch. It’s worth noting: Mexico requires monthly tax filings (Mexico: Your Launchpad for LATAM Amazon Expansion) (unlike the quarterly filings common elsewhere), so be prepared for that cadence.

- Amazon Fees: Refer to Amazon’s fee schedule for Mexico or Brazil. Referral fees might differ by category. FBA fees, storage fees, etc., are also country-specific. Ensure your pricing can accommodate these while still being attractive to consumers.

- Currency Exchange: The Mexican peso and Brazilian real can fluctuate against your home currency. Consider building in a buffer for currency movement, especially if your costs are in USD or CNY but revenues come in MXN or BRL. Latin America has higher inflation and currency volatility; a price that works today might need adjustment in a year. Plan for periodic pricing reviews.

By running a detailed profitability analysis (some call this a “landed cost analysis” or landslide costing (Mexico: Your Launchpad for LATAM Amazon Expansion)), you can determine an appropriate local price that yields acceptable margins. If the numbers look tight, revisit the strategy: maybe you need to reduce shipping costs (e.g., ship by ocean instead of air), or perhaps focus on a different product that has better margins after import. Never assume your U.S./EU pricing will simply translate – do the math country by country.

- Handle Compliance and Import Logistics

One of the biggest hurdles in LATAM expansion is the bureaucracy. The process of getting set up to import and sell can be complex, but it’s manageable with the right partners:

- Local Importer of Record: In most LATAM countries, to import goods, you either need a local legal entity with importation rights or you must appoint an Importer of Record (IOR). In Mexico, for example, you cannot just ship goods directly to an Amazon FBA centre without a registered importer handling customs (Mexico: Your Launchpad for LATAM Amazon Expansion). Many expanding brands partner with a customs broker or logistics company that can act as the IOR and handle all paperwork at the border. Alternatively, your client might set up a Mexican subsidiary and obtain an import license (padrón de importadores), but this involves time and cost. Most agencies opt for a local partner at first. Tip: Work with experienced, reputable firms based in the target country. As Vincenzo notes, in Latin America, it’s often about “who you know.” A local customs broker will know the ins and outs of the system – and yes, sometimes knowing the right people can fast-track your paperwork. Don’t try to DIY from afar; leverage local expertise.

- Regulatory Certifications: Check if your product type needs any special certification for entry. Common examples: electronics might need safety certifications (Brazil has the ANATEL certification, Mexico has NOM standards), cosmetics or supplements might need health ministry approvals. Amazon’s compliance tool (Seller Central’s Import Compliance Reference) is a great starting point – by inputting the product category and target country, it can list required documents or certifications for that marketplace. Use that to avoid surprises at customs. If anything is unclear, consult legal experts or Amazon’s Global Selling support.

- Corporate and Banking Setup: To receive disbursements from Amazon Mexico or Brazil, you don’t necessarily need a local bank (Amazon can convert and pay out to a foreign bank in many cases). However, having a local bank account can be useful for paying local suppliers or taxes. Determine what local presence is needed – some sellers operate via their U.S. or EU Amazon account linked to Amazon Mexico (through unified North America accounts or global selling), which simplifies things. Just ensure you’ve properly enabled Amazon Mexico/Brazil in your Seller Central (you may need to request access for Brazil specifically, as it’s not always enabled by default – opening a support case can activate Amazon Brazil in your account if it’s hidden).

- Fulfillment Plan: Decide where your inventory will be stored and how it will get to customers. You have two main choices:

- Remote Fulfillment (NARF): Amazon’s North America Remote Fulfillment program lets you fulfill Mexico (and Canada) orders from U.S. FBA stock. While easy to set up, it has drawbacks: slower delivery (international shipping) and the fact that customers must pay import fees on delivery, hurting conversion. It’s okay as a small pilot test for demand, but expect limited sales and some customer dissatisfaction. Many sellers find that once they switch to local FBA in Mexico, sales jump significantly (often 3-5x higher than with NARF)(Mexico: Your Launchpad for LATAM Amazon Expansion) because of faster Prime shipping and no surprise fees for buyers.

- Local FBA: The gold standard is to send inventory into Amazon FBA warehouses in Mexico or Brazil. This makes your products Prime-eligible locally, with the same shipping speed locals expect from any domestic seller. Yes, it requires dealing with customs and import in advance (as covered above), but the payoff is a much better conversion and customer experience. Aim to get on-the-ground stock for any market you are serious about.

- (Additionally, you could fulfill via a 3PL for Amazon (FBM) or use Mercado Libre’s fulfillment if selling there, but for maximising Amazon potential, FBA is key.)

- Remote Fulfillment (NARF): Amazon’s North America Remote Fulfillment program lets you fulfill Mexico (and Canada) orders from U.S. FBA stock. While easy to set up, it has drawbacks: slower delivery (international shipping) and the fact that customers must pay import fees on delivery, hurting conversion. It’s okay as a small pilot test for demand, but expect limited sales and some customer dissatisfaction. Many sellers find that once they switch to local FBA in Mexico, sales jump significantly (often 3-5x higher than with NARF)(Mexico: Your Launchpad for LATAM Amazon Expansion) because of faster Prime shipping and no surprise fees for buyers.

- Initial Stock and Replenishment: When first shipping to a new country, start conservatively. Don’t send a massive shipment until you’ve tested the waters. Maybe send 3 months of stock or a small batch to gauge demand. This avoids tying up too much capital in inventory that might move slowly at first. Once you see traction, you can replenish more confidently. Also, plan your replenishment lead time with customs in mind – shipments to Mexico might clear in days, whereas Brazil can sometimes take weeks. A buffer stock and careful logistics planning will prevent stockouts in a new market.

By laying this groundwork—market research, financial planning, and compliance logistics—you set the stage for a successful launch rather than a painful trial by fire. As the saying goes, “measure twice, cut once.” In international expansion, preparation is everything. Or as Freddy (another LATAM expert) put it, “It’s not something you can start tomorrow; it’s a process.” Treat it like a project and check all the boxes before listing your products for sale.

Localisation and Marketing: Adapting to the LATAM Consumer

Successfully launching in Latin America is not just a logistical exercise; it’s a marketing one. To resonate with local shoppers, you must speak their language – both literally and figuratively. This means fully translating and localising your content, and adjusting your marketing strategies to local consumer behaviour.

Language and Content Localisation:

Simply translating your Amazon listing with Google Translate isn’t going to cut it. For Mexico and most of LATAM, your content needs to be in neutral Spanish or country-specific Spanish. While many Spanish terms are universal, there are important nuances. Work with a native Spanish copywriter (ideally one familiar with Mexican Spanish) to rewrite your product titles, bullet points, and descriptions. They will choose phrases that feel natural to locals. For example, the word for “car” in Spain (“coche”) is “carro” in Latin America; small differences like that matter for connecting with the customer. Do fresh keyword research in Spanish as well – don’t assume the top keywords in Spain or the U.S. Spanish market are the same in Mexico. Use Amazon’s autocomplete or keyword tools set to Amazon.com.mx to gather the right high-volume search terms and incorporate those into your listing (including back-end search terms).

Beyond text, localise your images and graphics. If your U.S. listing images have English text overlays (e.g., infographics or feature callouts), recreate those in Spanish. Replace lifestyle imagery with photos that will resonate culturally – for instance, models that reflect the local demographics. If selling a kitchen appliance, a photo of a typical Latin American dish being prepared might connect better than a generic image. Such details help overcome any perception that you’re a foreign brand that doesn’t “get” the local culture. The goal is for a Mexican shopper to feel like “this brand is for people like me.”

Leverage Existing Brand Assets: If your client has already sold in the U.S. or Europe, bring over any social proof and brand reputation you can. One huge advantage on Amazon Mexico is that you can import your product’s U.S. reviews to your Amazon.com.mx listing. Amazon will display the aggregate rating and review count from Amazon.com on the .mx detail page (the reviews themselves are not all shown, but the star rating and count appear). If you have 1,000 reviews at 4.5★ in the U.S., your new Mexican customers will immediately see that credibility badge. This can dramatically boost conversion for a new market entrant – it’s an instant trust signal. Make sure to enable the option to show international reviews for your listings (it’s usually automatic if the products are linked in a unified account, but double-check). Social proof travels well and gives you a head-start against local competitors.

Local Marketing Tactics:

Marketing in LATAM has its own flavour. One striking insight from Vincenzo is the outsized role of influencer marketing in Latin America. Consumers here are extremely tuned in to social media influencers and often show a level of loyalty and trust in them that exceeds what you see in the U.S. or Europe. “Influencer marketing in Latin America is huge… People are very loyal to the influencer. If the influencer says ‘buy this’, they buy it, regardless of price,” Vincenzo says. This suggests that agencies should consider an influencer component in their launch strategy. Identify popular influencers in your product’s niche (Instagram, YouTube, and TikTok are all big in LATAM). They don’t have to have millions of followers – even micro-influencers can drive a tight-knit local community. Engage them to create content around your product, perhaps unboxings or testimonials in Spanish, and use those as ads or social proof.

Moreover, you can repurpose influencer-generated content on your Amazon listing. For example, include an image of the influencer using the product as one of your gallery images (with permission, of course). Shoppers scrolling through will recognise a familiar face, which builds trust. Many brands launching in Mexico have successfully run influencer campaigns leading up to the Amazon launch, so that by the time the product is live, thousands of potential customers have already heard about it on Facebook or YouTube. Word-of-mouth travels fast in Latin America – it’s a community-oriented culture. So, invest in buzz-making activities: social media contests, referral programs, and even WhatsApp group promotions if applicable. These may be outside the typical Amazon playbook, but they can significantly amplify your reach.

Advertising on Amazon: Once your content is localised and your product is live, you’ll likely use Amazon PPC to gain visibility. The good news is that Amazon’s advertising platform in Mexico and Brazil is very similar to the U.S., but with much lower cost-per-click (CPC) due to lower competition. Take advantage of this. Allocate budget to Sponsored Product ads on your top Spanish keywords immediately to start capturing market share. You might find that a small budget goes a long way – but don’t be complacent, as more sellers are entering each day. Also, consider Sponsored Brands ads if you have Brand Registry, to showcase your brand logo and a custom headline in Spanish (another chance to speak directly to local customers). In Brazil, you’ll need Portuguese ads and content – it’s worth hiring a native Portuguese expert when the time comes.

Customer Experience: Finally, adapt to how LATAM consumers shop. Many Mexican and Brazilian customers prefer mobile shopping, so ensure your listings are mobile-friendly (clear images, concise text). They also may use different criteria – for instance, installment payments are common in some countries for higher-priced goods. Amazon Mexico allows sellers to offer 12-month interest-free installment options to customers with certain cards. Participating in that program could remove a purchase barrier for big-ticket items. Keep an eye on reviews and questions, and respond in Spanish promptly. Stellar customer service (even just polite, localised responses to reviews) can set you apart as a brand that cares about the market.

In essence, treat your LATAM launch with the same level of localisation you would for a country in Europe or Asia. Don’t treat Latin America as an extension of the U.S. – treat it as a collection of unique, vibrant markets with their own identity. Your extra effort in localisation and targeted marketing will be rewarded with customer loyalty and brand growth.

Common Pitfalls and How to Avoid Them

Entering Latin America can be hugely rewarding, but it’s not without challenges. Many brands (and agencies) make mistakes in their first foray that cost time and money. Here are some common pitfalls to avoid, distilled from Vincenzo’s experience and others, so your expansion can hit the ground running:

- Overestimating Demand: Enthusiasm is great, but don’t let it override data. A classic mistake is assuming a product that sells 1,000 units a month in the U.S. will automatically sell 1,000 a month in Mexico. Some brands have shipped pallets of inventory to Amazon Mexico only to find that the core keyword is barely searched there, or that a local brand sells a much cheaper alternative. Avoid this by thoroughly validating demand (as discussed) and starting with small shipment volumes. You can always send more once you see sales picking up. It’s better to stock out and restock than to tie up capital in stagnant inventory abroad. Remember, any inventory sitting unsold in Mexico is inventory that could have been generating sales in your core market – so be judicious.

- Ignoring Compliance and Paperwork: Latin bureaucracies can be unforgiving. If you don’t have your import paperwork in order, your goods could get stuck in customs for weeks or even be sent back. Vincenzo shared a hard-earned lesson: early on, his team missed a required certificate for a shipment, and the products got stranded at the border – an expensive delay. The remedy is to double-check compliance before shipping. Use Amazon’s tools, hire that local customs broker early, and ensure every box and pallet has the proper labels and documents. Also, don’t forget about tax compliance – not registering for VAT/RFC in Mexico or failing to file can result in account issues. Essentially, cross your t’s and dot your i’s when it comes to regulations. The extra diligence upfront will save massive headaches later.

- Poor Translation/Localisation: We’ve touched on this, but it bears repeating as a pitfall because it is so common. Many sellers have flopped in LATAM simply because their listing was an awkward Spanish translation full of errors, or their marketing assumed things about the culture that were off-base. Vincenzo admitted that in the beginning, they tried to cut corners by reusing Spanish content from Spain – and it didn’t resonate in Latin America, costing them ad dollars with little return. Don’t treat localisation as optional; it’s mandatory for success. If you don’t have in-house capabilities, invest in professional translation and copywriting. The conversion rate lift will more than pay for it.

- Underestimating Lead Times and Costs: Expanding abroad is not as quick as launching a new product at home. Obtaining tax IDs, setting up accounts, coordinating international freight – these all take time. A pitfall is promising a client that they’ll be up and selling in Mexico in “a few weeks,” only to hit delays that push it to a few months. Be realistic in planning and communicate timelines that account for potential delays (political events, holidays slowing customs, etc.). Also, budget for one-time costs like hiring consultants or paying import duties upfront. Build a cushion in your plan, both in time and money. It’s better to come in under budget or faster than expected than the opposite.

- Pricing Missteps: Getting your price right in a new market can be tricky. One mistake is to simply convert your USD price to MXN or BRL at current exchange rates and set that as the price. This might make your product wildly overpriced relative to local alternatives, or even unprofitable after local fees. Conversely, pricing too low (to “gain share”) without accounting for high import costs could mean losing money on each sale. The solution is a careful pricing strategy: research competitor pricing in the local currency, know your full landed cost, and find a sweet spot that offers value to customers while sustaining your margins. Don’t forget to factor in currency fluctuation over time – you may need to adjust prices periodically. Monitor your margins in local currency terms, not just your home currency.

- Lack of Local Support: Trying to manage everything from afar is possible, but having feet on the ground is a big advantage. Whether it’s a dedicated hire, an agency partner, or even just a very reliable freight forwarder, ensure someone with local knowledge is in your corner. They can alert you to changes in regulations, help resolve issues faster, and provide cultural context when needed. Agencies sometimes try to do it all in-house to save cost, but wasting weeks because no one on the team speaks Spanish or understands Mexican tax forms will cost far more. Don’t skimp on partnerships and local talent.

By being aware of these pitfalls, you can proactively prevent them. Expand with humility and patience – know that you’re entering a new environment and there will be a learning curve. If something does go wrong, don’t be discouraged. Many successful sellers have early stories of shipments stuck in customs or initial slow sales. Learn from those, adapt, and keep going. The opportunity in LATAM is big enough to reward those who persist and optimise.

Conclusion: Seize the LATAM Momentum (CTA)

Latin America represents the next great growth frontier for Amazon-focused brands and agencies. Yes, there are hurdles – from import red tape to localisation challenges – but the rewards of getting in early can be game-changing. As we’ve discussed, a strategic approach (starting with Mexico, preparing diligently, localising deeply, and leveraging Amazon’s support programs) can set you on the path to success in LATAM markets. The consensus from experts is clear: this is the time to ride the wave. The e-commerce surge in LATAM is happening now, and established brands have a unique chance to become category leaders before the waters get crowded.

Is expanding to Amazon Latin America right for your clients? For many, the answer will be yes – provided it’s done with care and local insight. Don’t wait until the market is as mature (and competitive) as the U.S.. By then, the cost of entry will be much higher. Instead, consider mapping out a LATAM expansion roadmap for 2024 and 2025, and start laying the groundwork as outlined in this article.

If you found these insights valuable, be sure to watch the full webinar on LATAM expansion (available on-demand via MerchantSpring’s Marketplace Masters series) for even more nuance and real examples. Feel free to reach out to the experts involved – Vincenzo Toscano at Ecomcy (Connect on LinkedIn) is open to helping brands navigate international growth, and Paul Sonneveld at MerchantSpring can advise on optimising marketplace performance across regions.

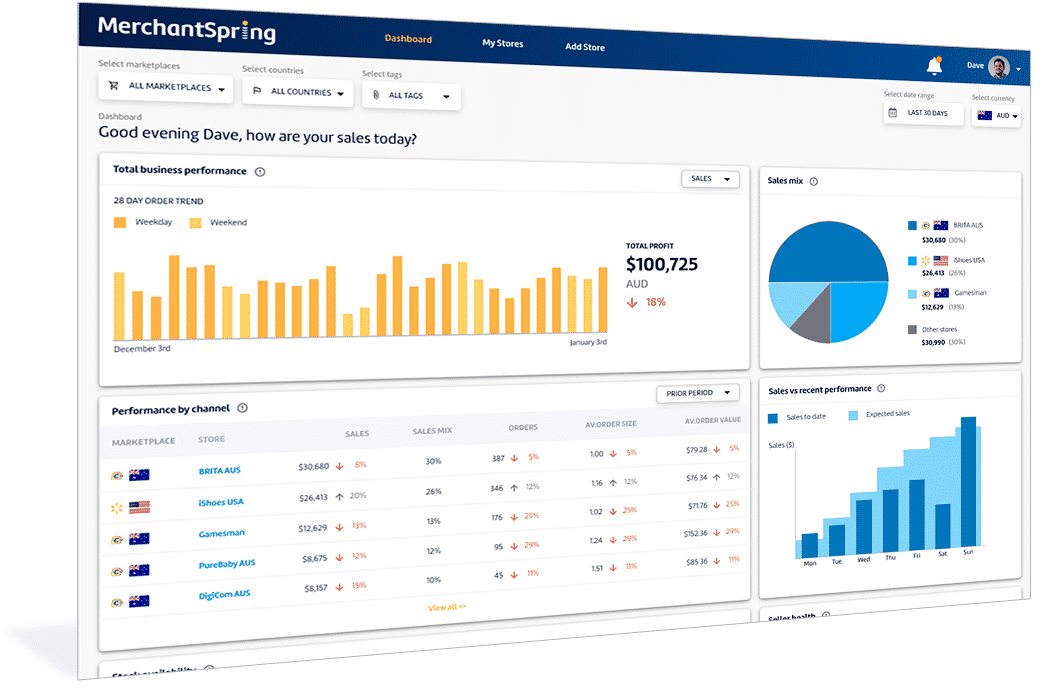

As a final offer to agency professionals reading this: MerchantSpring’s analytics platform is purpose-built for managing multi-marketplace operations. If you’re launching clients on Amazon Mexico, Brazil, Mercado Libre or elsewhere, our tool can unify all your reporting and help your account managers stay on top of performance in every country (with far less manual effort). Get in touch with MerchantSpring to learn how we can support your LATAM expansion with data and insights – we’d love to help you make this global leap a success.

Ready to expand your clients’ reach and revenue? Contact us today for a consultation on your Amazon LATAM expansion strategy, and let’s unlock new growth for your agency and your brands.

-Sep-19-2025-01-20-46-0011-AM.png)

Add a Comment