Boost Amazon Vendor Profits With Data Accuracy & Merchandising

Overview

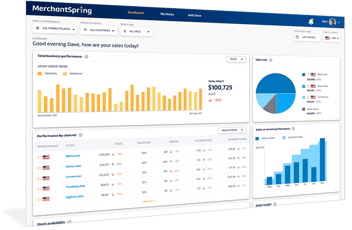

Amazon Vendor Central offers a wealth of data and tools, but many agencies and brands struggle to harness them fully. In this episode of Marketplace Masters webinar, host Paul Sonneveld, co-founder of MerchantSpring (a leading vendor analytics platform), sat down with Cagan Aceter, founder of Margad (an agency of ex-Amazonians), to discuss two critical pillars of vendor success: accurate retail analytics and non-advertising merchandising levers. They revealed how cleaning up your Vendor Central data can unlock powerful strategies beyond paid ads – from leveraging Subscribe & Save to running Amazon Deals – all aimed at boosting profitability for brands and Amazon agencies.

“Getting retail analytics data accurate is actually quite hard. More often than not, there are issues with the catalogue or setup... and it’s really hard to make commercial decisions off that.” — Paul Sonneveld, MerchantSpring CEO

In this comprehensive guide, we’ll synthesise their expert insights into actionable strategies. You’ll learn how to identify and fix common data gaps that skew your Amazon Vendor analytics, and how to pull the right merchandising levers (outside of advertising) to drive growth. We’ll also weave in the latest best practices and trending tactics that Amazon agencies are searching for today – from resolving missing ASINs to maximizing Subscribe & Save. By the end, you’ll understand how clean data and smart promotions go hand-in-hand to elevate Amazon Vendor performance. Let’s dive in.

The Importance of Clean Retail Analytics Data

Accurate data is the foundation of every sound Amazon strategy. Vendor Central’s Retail Analytics dashboards (formerly ARA) can be powerful, but only if your data isn’t full of holes. Unfortunately, many vendors encounter data gaps – missing products, incorrect categorisations, or mysterious discrepancies – that undermine trust in the numbers.

Common data accuracy issues on Amazon Vendor Central include: missing ASINs in reports, mis-mapped or duplicate brand codes, and differences between the “Manufacturing” and “Sourcing” views of data. These issues often trace back to how Amazon’s systems associate your products with your vendor account. For example, if an ASIN isn’t mapped to the correct brand code under your vendor code, it might not appear in your analytics at all(consulterce.com). Cagan noted that the number one culprit is missing ASINs due to brand code misconfiguration: if an ASIN’s brand code isn’t properly tied to your Vendor Central account, Retail Analytics will simply omit that product’s data.

Why does this happen? Sometimes it’s human error during Amazon’s onboarding or catalog setup; other times it’s an Amazon system glitch that disassociates a product from your account. Brand codes – the identifiers linking products to brands and vendors – can multiply with slight typos or case differences, making a mess of the hierarchy. In Amazon’s internal structure, each vendor has a company code (global entity), under which are parent vendor codes (usually regional entities), then child vendor codes, and finally one or more brand codes under each vendor. Ideally, all your ASINs’ brand IDs should map to the brand codes that belong to your vendor code. If anything in that chain is broken – say an ASIN was created under a different brand spelling, or Amazon thinks another vendor “owns” that brand – your reports will have blind spots.

Why does clean data matter? Because you can’t manage what you can’t measure. If your analytics are wrong or incomplete, every decision from inventory buys to marketing spend is on a shaky foundation. As Cagan put it, missing data “pulls a brick out from under your foundation.” You can’t calculate true ASIN-level profitability, you can’t forecast properly, and you might mis-identify your best or worst performers. In his words:

“If you don’t have the proper data, it essentially pulls a brick out from under your foundation – you can’t apply a unit economics strategy, you can’t forecast, you can’t make good decisions. It breaks everything.” — Cagan Aceter

In short, dirty data = missed opportunities. Accurate analytics directly impact your ability to optimise merchandising and profitability. In the next section, we’ll cover how to detect and resolve these data issues.

Identifying & Fixing Data Gaps in Vendor Central Analytics

How do you know if your Vendor Central data has gaps? Start by auditing your ASIN list against your reports. Pull a list of all ASINs you’ve sold or had purchase orders for, then compare it to the ASINs appearing in your Retail Analytics reports (especially the Manufacturing view’s catalogue report). If you find products that you’ve sold to Amazon that aren’t in your analytics, that’s a red flag. Conversely, watch for any ASINs showing up in your reports that you don’t actually sell – a sign that Amazon may have mixed in another vendor’s data by mistake due to a brand code mix-up.

A practical tip from the webinar is to export your cost file or catalogue listing (which shows all ASINs you’ve set up with cost prices) and cross-reference it with a Manufacturing View sales or inventory report. This quickly surfaces missing ASINs. Also monitor for sudden inexplicable drops or spikes in sales of a top ASIN – if a best-seller “disappears” from your data, it could be a mapping issue rather than a real sales decline(reasonautomation.com).

Steps to fix data issues:

- 1. Confirm the Manufacturing vs. Sourcing View: First, ensure you’re looking at the right view. The Manufacturing View in Vendor Central Retail Analytics shows sales of your brand’s products across all vendors (you and any third-party distributors Amazon uses), while the Sourcing View shows only what your vendor account shipped to Amazon. Many times, an ASIN isn’t “missing” – it’s just only visible in the Manufacturing view. (Manufacturing view also unlocks extra data like traffic and net PPM tabs, which are invaluable.) If you’re missing an ASIN in Sourcing, switch to Manufacturing to see if it appears via another vendor’s inventory(consulterce.com). If it’s missing from both, you likely have a true mapping issue.

- 2. Check for Brand Code Misalignment: If an ASIN you sell isn’t in Manufacturing view, it means Amazon doesn’t think that product’s brand belongs to you. This requires reaching out to Amazon to fix the brand code mapping. Open a case with Vendor Support (or work with your Amazon vendor manager or AVS if you have one) with details: the ASIN, its brand name, and your vendor code, explaining that it’s not appearing in your reports. Persistence is key – it may take multiple tickets and clear evidence. Amazon can remap the ASIN’s brand code on the back-end to assign it to your account. In Cagan’s experience, you should be “consistent and persistent” in chasing Amazon until they correct the catalogue data.

- 3. Audit Regularly: Make data audits a routine (weekly or monthly). Don’t assume that once fixed, it stays fixed – new ASINs can suffer the same fate. Implement an “audit mechanism” – even a simple spreadsheet check – to continually verify your retail analytics data. Many successful agencies literally maintain a master ASIN list for each client and ensure every one is reflected in the reporting. Modern tools like MerchantSpring’s Retail Analytics Dashboard have built-in data gap detectors (an “audit mechanism” feature) that can highlight missing ASINs or sales anomalies automatically, saving you time.

- 4. Leverage Vendor Central APIs or Bulk Reports: For advanced users, the Amazon Selling Partner API (SP-API) offers programmatic access to Vendor Central data. This can be used to pull daily reports and cross-verify ASIN counts. Some agencies even use the SP-API’s Catalog endpoints or Vendor Analytics “data lake” APIs to fetch comprehensive data and ensure nothing is falling through the cracks. If you have the resources, integrating these APIs into a dashboard (or using a solution like MerchantSpring that already does) can give you near real-time alerts on data integrity. (Tech tip: The SP-API’s “Vendor Retail Analytics” endpoints can supply the same data as the dashboards, and some agencies use the Pricing API or scraping methods to monitor things like Buy Box ownership since Amazon removed the Lost Buy Box metric(reasonautomation.com).)

By diligently fixing data gaps, you set the stage for data-driven decision making. As the speakers emphasized, accurate analytics let you calculate true profitability, diagnose conversion issues, and confidently invest in growth. With our data house in order, let’s turn to those merchandising levers that can drive growth beyond advertising.

Beyond Ads: Unlocking Amazon’s Merchandising Levers

Every Amazon vendor knows about advertising (AMS, Sponsored Ads, DSP). But Vendor Central offers a suite of merchandising programs beyond paid ads that can significantly boost sales when used wisely. In Vendor Central’s interface, these live under the “Merchandising” menu – and include tools like Subscribe & Save, Deals (e.g. “Best Deals” and Lightning Deals), Coupons, and Vendor Powered Coupons (VPC), and even Showcases. Unlike advertising, these are often investments in pricing or promotions that can drive volume and improve discoverability. Paul pointed out that Amazon itself pushes these because they drive conversion and customer loyalty (and yes, Amazon loves them because they move inventory).

However, not all levers are equal. Which ones are truly worth it for vendors? Here’s the rundown:

Subscribe & Save – Building Loyalty (When It Fits)

Subscribe & Save is a program allowing shoppers to subscribe to regular deliveries of your product at a slight discount. For vendors, Amazon funds a base discount (usually ~5%), but often asks the manufacturer to fund an additional discount tier (10-15% for 5 or more subscriptions, for example). This lever shines in replenishable, consumable categories – think grocery, pet food, vitamins, personal care – where repeat purchases are common. Cagan noted that for CPG brands and any consumable product, Subscribe & Save can be a huge driver of repeat sales and customer lifetime value. It not only boosts sales volume but also improves forecasting (steady subscription orders) and can improve your Amazon vendor negotiation position by showing Amazon you drive sticky customers.

Best practices for Subscribe & Save:

- Start with a Moderate Discount: You want the offer to be enticing, but avoid steep discounts that destroy your margin, especially at scale. Many vendors offer the minimum 5% or 10%. Keep an eye on the subscribe rate – if very few take the subscribe option, you might increase the discount slightly. If too many subscribe and it hurts margins, you may have gone too high.

- Leverage Amazon Retargeting: Once Subscribe & Save is running, those subscribers are a captive audience. Amazon often sends reminder emails to subscribers and features those products in email campaigns. You can also combine this with targeted marketing – for example, run a Vendor Powered Coupon or a remarketing campaign to people who viewed the product, encouraging them to subscribe. As Paul suggested, re-targeting audiences who bought once to convert them to subscribers can amplify the benefits.

- Watch the Cost of Goods & Funding: Remember that Amazon will recoup the discount you fund through deductions. Model out the impact on net PPM (profit margin). If you’re in a razor-thin margin business, a 15% Subscribe & Save discount might not be feasible at high volumes.

“If those repeat purchases create more share in your portfolio, and they’re not profitable, then you have a problem… It’s great to calculate customer lifetime value, but you need to also consider your yearly profits because you negotiate annually with Amazon.” — Cagan Aceter

The bottom line: Use Subscribe & Save for products with strong lifetime value, and monitor its impact. It can drive reliable re-orders and defend market share, but don’t let the tail wag the dog – ensure your subscribed sales remain profitable after discounts.

Amazon Deals & Promotions – Spiking Sales During Key Periods

Amazon’s Deals (found under Merchandising > Deals in Vendor Central) include time-bound promotions like “Best Deals” (multi-day deals often featured on the Deals page) and Lightning Deals (flash sales). Vendors typically fund a discount (a fixed $$ or % off), and Amazon may amplify it. Cagan was enthusiastic about deals, calling them “the most profitable and best growth lever” among the merchandising options for many clients. Here’s why:

- Deal Visibility: Products on deal often get the “Deals” badging and appear on high-traffic deal pages or widgets. During big events (Prime Day, Black Friday Week, Cyber Monday, etc.), Amazon heavily promotes these. A well-timed deal can flood your listing with traffic and significantly lift sales during the event. We’ve seen brands clear months of inventory in a matter of days with a successful deal.

- Amazon Co-Funding: When you submit a deal, Amazon asks for a funding amount (essentially, your margin contribution). If Amazon deems your product and funding sufficient, they may add their own margin reduction on top. For example, you agree to fund $5 off; Amazon might discount the product $8 or $10 off on the site, effectively contributing the rest. Amazon does this when the product’s economics allow (they have enough margin to play with), and it helps them be more price-competitive and attractive to shoppers. This means shoppers get a bigger discount than you alone fund, supercharging the deal’s appeal.

- Negotiating Funding: If you have a good Amazon contact (Vendor Manager or AVS), you can sometimes negotiate a lower funding requirement or get guidance on how to qualify for deal events. Amazon might say, for instance, if you can fund 10% off, they will feature you in a category deal page. It’s worth asking your Amazon rep about deal opportunities in Q4 or other peak seasons – often, they have promo slots to fill.

- Event Alignment: Align deals with Amazon’s event calendar. Prime Day, Cyber 5 (Black Friday through Cyber Monday), Prime Fall Deal Event, etc. are prime times (pun intended) to run deals. Outside of those, even events like Mother’s Day or Back-to-School can be hooks. Deals during these periods can boost not only sales but also organic ranking (thanks to the velocity spike), leading to longer-term benefits.

A few caveats: Deals require that your product has a good sales history and a minimum sales velocity (Amazon wants to promote winners). There’s also usually a rule that the deal price must be the lowest in a 30-day lookback, so plan your pricing moves accordingly in advance. Additionally, deals have lead times – often you must submit weeks in advance. As Cagan noted, you can’t usually wake up and launch a deal “right away”; the fastest he’s seen is a couple of days, but normally you schedule them 2+ weeks out. Sellers (3P) have some more flexibility with Prime Exclusive Discounts that can start in a day or two, but vendors have to play by Amazon’s timeline.

“For us, the Best Deals and participating in event periods are the most profitable growth levers. If you have a proper point of contact at Amazon, you may even negotiate the funding. And Amazon will amplify your discount – the customer gets more off than you fund.” — Cagan Aceter

In summary, use Deals strategically to spike traffic when it counts. They’re particularly useful for product launches (to gain traction) or to clear excess inventory, or simply to boost your Q4 numbers. Just ensure you have inventory to handle the lift, and that your internal margin can handle the funding.

Other Vendor Promotions: Coupons and Showcases

Beyond Subscribe & Save and Deals, vendors can leverage Coupons and Vendor Powered Coupons (which put a coupon badge on the listing – great for conversion lift) and Showcases. Showcases are a somewhat lesser-known program in Vendor Central where Amazon’s site merchandising team can feature your brand or products in a curated way (often on category pages or special placements). These usually require working with your Amazon contact and often some funding or a pitch. While the webinar didn’t dive deep into showcases, the consensus was to focus on the high-impact levers first (Deals and Subscribe & Save) unless you have specific guidance from Amazon to try other programs.

Vendor vs. Seller Promotions: It’s worth noting how vendor promotions differ from third-party (Seller Central) ones. On Seller Central, you have more DIY control – a seller can, for example, set up a coupon or a sale price that goes live almost immediately, or run Prime Exclusive Discounts on their own schedule. Vendor promotions, by contrast, often need Amazon’s approval or scheduling. The trade-off is that Amazon Retail might contribute their own margin to make vendor deals juicier, and vendor items on deal can benefit from Amazon’s push. However, as Cagan bluntly said, many growth levers appear stronger on the Seller side for agility. Sellers can do things like 1-day flash sales or brand-tailored promotions more freely. Vendors should therefore plan ahead and communicate with Amazon to make the most of merchandising opportunities. If you need an immediate sales boost (say, to hit a month-end number), a vendor is a bit more constrained than a seller who could just drop prices for a weekend. The key for vendors is planning and negotiating – use your annual terms negotiation and regular VM/AVS calls to secure promo slots.

Marrying Data Accuracy with Merchandising Strategy

By now it’s clear: clean data and smart merchandising go hand in hand. How exactly does accurate analytics enable better use of these levers?

For one, if your Retail Analytics data is complete, you can accurately gauge the lift and ROI of promotions. You’ll trust the sales uptick numbers from a deal, or see the baseline vs. post-promotion units to calculate incremental sales. You can measure conversion rate changes when a coupon is applied, or track subscription rates after tweaks to Subscribe & Save discounts. Without accurate data, you might falsely conclude a promotion didn’t work (when in reality an ASIN’s sales were just not recorded fully).

Accurate data also helps in identifying which levers to pull. For instance, your traffic and conversion data might show that a certain ASIN has lots of views but a low conversion rate. That’s a prime candidate for a conversion-driving lever like a Coupon or a Deal to juice the conversion. Or you might find a group of ASINs with consistent repeat purchase behaviour – a hint that Subscribe & Save could amplify that natural loyalty. Moreover, manufacturing vs. sourcing view comparisons can reveal how much of your sales Amazon is procuring from other sources. If a lot of sales are happening via other distributors (i.e., manufacturing view much larger than your sourcing view), you might decide to offer Amazon a better deal (via terms or promotions) to win that volume directly. Alternatively, it could signal you should focus advertising and promotions on the ASINs Amazon does buy from you to maximize your slice of the pie.

One powerful analysis is to look at unit cost differences between you and other vendors. MerchantSpring’s Retail Analytics dashboard, for example, can compare the average unit cost Amazon pays you vs. what it pays when sourcing elsewhere (using manufacturing view COGS data). If Amazon is paying another vendor less for the same product, that might explain why your share of orders is lower – and it might push you to adjust your cost or invest in a deal to stay competitive. These kinds of insights only surface with complete data.

Finally, having clean data allows for better forecasting and inventory planning around promotions. You’ll know your true baseline sales, so when you plan a 5-day deal, you can forecast lift (e.g., 5x normal volume) and ensure Amazon orders enough. You can also quantify the impact of promotions on overall business performance – the webinar speakers emphasised that beyond the immediate sales spike, a successful promotion can improve your organic rankings, help launch new products, and even positively impact your annual terms (Amazon may order more and be more willing to negotiate if they see you driving volume).

Pro Tips: Tools and Tactics for Amazon Agencies

For Amazon agency professionals managing multiple vendor clients, it’s crucial to have the right tools and processes:

- Use a Unified Dashboard: Manually checking Vendor Central for each client is tedious and error-prone. Consider using a specialised analytics dashboard (like MerchantSpring’s Vendor Retail Analytics Dashboard) that consolidates all your clients’ Amazon data in one place. These platforms often provide enhancements – e.g., automatic conversion rate calculation, lost Buy Box alerts, or anomaly detection. They can save hours and catch issues you might miss.

- Implement an Audit System: Earlier we mentioned auditing data regularly. As an agency, standardise this. For example, create a monthly “Data Health Report” for each client – list total ASINs shipped vs. ASINs in analytics, highlight any mismatches, and check that key metrics like glance views and ordered units are tracking logically. Many agencies build this into their SOPs, ensuring clients’ Amazon data quality is always under watch.

- Connect Back to Amazon’s Metric Glossary & Support: Amazon documentation (like the Retail Analytics FAQ and metric glossary) is continually updated(bebolddigital.com). Stay up to date with changes – for instance, Amazon is constantly tweaking the Retail Analytics dashboards (in 2022 they deprecated some old metrics like Lost Buy Box(reasonautomation.com), and in 2024/2025 they rolled out new ARA Premium features). Knowing these details helps you explain to clients any data quirks (“Amazon no longer reports X, but we can calculate it by…”).

- Backlinks and Knowledge: Keep handy authoritative references for deep dives. For example, Amazon’s own Vendor Central help pages on Subscribe & Save and Deals can provide requirements and tips (e.g., minimum funding, lead times). Also follow experts like Martin Heubel (Consulterce) who share vendor tips – e.g., reasons for missing ASINs(consulterce.com), or how Net PPM is calculated(consulterce.com) – so you can troubleshoot advanced questions.

By combining these tools with the strategies discussed, agencies can deliver exceptional value – ensuring clients have rock-solid data and creative, effective promotion plans beyond just running ads.

Conclusion: Turn Insights into Action

Accurate retail analytics and savvy use of merchandising levers are a powerful one-two punch for Amazon vendors. When your data is clean and complete, it shines a light on where to act – and when you act via programs like Subscribe & Save, Deals, and Coupons, you can boost sales in ways your competitors might miss. The key takeaway from Paul and Cagan’s discussion is that success on Amazon Vendor Central isn’t just about advertising; it’s about getting your own house in order (data integrity) and taking advantage of every tool in Amazon’s toolbox to drive growth and profitability.

By fixing data gaps like missing ASINs and leveraging non-advertising levers, vendors can achieve new levels of performance. Imagine confidently reporting to your client or boss that due to accurate analytics, you identified a 10% revenue undercount (now recovered), or that a strategic Best Deal drove a 300% sales lift on a key item, or that Subscribe & Save subscriptions grew 5x after a tweak in discount – and all of it is backed by trustworthy data. This is the art and science of Amazon vendor management.

Ready to put this into practice? Don’t stop here. This blog barely scratches the surface of the live conversation and examples shared in the webinar. Watch the full webinar on demand to hear Paul and Cagan walk through real scenarios and nuanced tips (it’s available in MerchantSpring’s on-demand library). If you found these insights useful and want to stay ahead in the Amazon game, subscribe to our newsletter for regular expert content like this. And if your agency or brand could use a more advanced analytics solution, or you need help auditing your Vendor Central data, book a demo of MerchantSpring – we’d love to show you how our platform can transform your Amazon vendor analytics and identify growth opportunities in minutes.

It’s time to elevate your Amazon Vendor performance. Clean up your data, pick a lever (or two) to pull this quarter, and watch the results. And remember, you’re not alone on this journey – join our community of Amazon professionals learning and sharing what works. Let’s unlock that Vendor Central potential together. 🚀

%2099.png)

Add a Comment