CRaP-Proof Your Products: What Agencies Must Do to Protect Their Clients

Overview

Amazon vendors face a paradox: some of their best-selling products can suddenly become “CRaP”—Amazon’s blunt acronym for “Can’t Realise a Profit.” When a product gets hit with the CRaP label, Amazon stops ordering it and slashes its visibility, leaving vendors scrambling to salvage sales. In this guide, we’ll explore why products fall into Amazon’s CRaP category and, more importantly, how to avoid or recover from this situation. Drawing on expert insights from an episode of the Marketplace Masters webinar with Will Haire of BellaVix, we’ll turn these hard lessons into actionable strategies. Whether you’re an Amazon agency professional managing client accounts or a vendor yourself, this comprehensive playbook will help you navigate Amazon’s profitability mandates and keep your products safely off the CRaP list.

What is Amazon’s CRaP Policy (and Why It Matters)?

“CRaP” stands for Cannot Realize a Profit – Amazon’s internal shorthand for products it sells at a loss. If Amazon’s systems determine an item isn’t financially viable (based on its net pure profit margin, or net PPM), they’ll stop ordering it for retail and may even suppress the listing. In practical terms, a CRaP designation halts your 1P (first-party) sales dead in their tracks.

“When your products become CRaP, Amazon will stop ordering them – you lose sales and rankings, Subscribe & Save gets turned off, and even your ads and promotions grind to a halt.” — Will Haire, CEO & Co-Founder of BellaVix

Amazon takes this step to protect its own margins. Remember, as a 1P vendor you’re essentially a wholesaler to Amazon – and like any retailer, Amazon won’t stock items that hurt their bottom line. Historically, many low-cost, everyday items fell into the CRaP category because the cost to pick, pack, and ship was greater than the product’s margin. Amazon’s retail leadership has even noted that reducing the “cost to serve” these products (e.g. through more efficient logistics) is key to expanding selection profitably. Until those efficiencies fully materialise, though, vendors must proactively manage their portfolio’s profitability. In short, if Amazon can’t make money on your product, it’s CRaP – and that’s a situation you need to foresee and prevent.

How to Tell if a Product is at Risk of CRaP

Amazon doesn’t usually give advance warning that a product is slipping toward CRaP status. As Will Haire explained, once your item’s profit profile falls below Amazon’s threshold (measured by net PPM), the hammer drops almost automatically. You’ll receive an email notice, and the item becomes unorderable on Vendor Central. The key is to monitor the telltale signs before that happens:

- Low or Negative Margins: Obviously, if Amazon’s margin on the item is razor-thin or negative, it’s a CRaP candidate. Check your Vendor Central reports for net PPM by ASIN. Anything significantly below your category’s average margin is a red flag. (Amazon doesn’t publicise the exact cutoff, but vendors have seen items get CRaPped even with small positive margins because they weren’t enough to cover Amazon’s operating costs.)

- Low Price Points: Products with low retail prices – typically under $15 – often can’t cover Amazon’s fixed fulfillment costs per unit (picking, packing, shipping). Unless these items have exceptional turns or vendor terms, they’re inherently vulnerable. A $10 item, for example, leaves very little room for Amazon to profit after shipping and handling.

- High Shipping or Handling Costs: Bulky or heavy items that incur outsized shipping fees are prime CRaP material. If an item’s price-to-weight ratio is poor, Amazon’s cost to deliver it may wipe out the profit. Think oversized household goods, cheap furniture, cases of water – the kind of products that are expensive for Amazon to move and store relative to their price. Shipping in Own Container (SIOC) certification can mitigate this by optimising packaging, but more on that later.

- Frequent Price Matching: Amazon’s algorithms relentlessly price-match lower offers on other websites. If your product is being sold cheaper by Walmart, Target, or unauthorised third-party sellers, Amazon will drop its retail price to stay competitive – even if it means selling at a loss. This “race to the bottom” can quickly erode Amazon’s margin. As an agency or vendor, inconsistent pricing across channels is one of the first things to fix (via MAP policies or distribution agreements) to protect your Amazon sales. Inconsistent pricing = inconsistent profits = CRaP risk.

- High Return Rates: Products with above-average return rates are costly for Amazon. Processing returns eats into margins, especially if the agreed vendor allowances for damages/returns don’t fully cover it. A high return rate (perhaps due to quality issues or misleading listings) can tip an item into unprofitability. Watch your returns data – if an ASIN has excessive returns, address the cause ASAP (quality control, better descriptions, improved packaging, etc.) before Amazon flags it.

- Overstock and Markdowns: If Amazon over-ordered your item and it’s sitting unsold, they may eventually start marking it down to clear inventory. Those markdowns hit Amazon’s margin and can trigger CRaP status. Overstock can happen if a vendor pushed too much product (for instance, via a big Born To Run initial order) or if demand dropped unexpectedly. Either way, excess inventory + markdowns = margin pressure. It’s another reason to keep a close eye on sell-through and not load Amazon with more stock than you’re confident will sell.

In summary, any factor that increases Amazon’s cost or lowers the price of your product can jeopardise its profitability. As an Amazon-focused agency, you should routinely audit your clients’ items for these risk factors. A proactive review of pricing consistency, weight-to-price ratios, margins, and returns can literally save a product from falling off Amazon’s virtual shelf.

Proactive Strategies to Avoid the CRaP List

The best cure for CRaP is prevention. By baking profitability into your Amazon strategy from the start, you can spare yourself the pain of rescue missions later. Here are the key preventative measures that vendors (and the agencies who support them) should implement:

- Enforce Strict Pricing Governance (MAP Policy): Uncontrolled discounting is a CRaP accelerator. A strong Minimum Advertised Price (MAP) policy, diligently enforced across all retailers, is your first line of defence. Ensure no authorised reseller is undercutting your set price floor. More importantly, monitor for unauthorised sellers who might dump your products at rock-bottom prices (e.g. grey market or liquidators). Using MAP monitoring tools or services can help catch violations. “Your MAP policy is only as good as its enforcement,” as Will Haire puts it. Consistent pricing not only protects your brand’s value but also protects Amazon’s margin, keeping your ASIN off their naughty list. If you don’t have a MAP policy, work with legal counsel to establish distribution agreements that curb price erosion.

- Optimise Product Assortment and Packaging: Not every product is cut out for Vendor Central. Analyse your catalogue and choose the right fulfillment channel for each item. Low-priced, low-margin items may be better suited for Seller Central (3P), where you control retail price and can bundle in shipping fees. Alternatively, consider packaging or bundling solutions: for example, instead of selling a $10 item as a single unit to Amazon, offer it as a 3-pack for $30. Bundling raises the average unit price and shipping efficiency, giving Amazon more profit cushion. Likewise, adapt overly heavy or bulky products – can you reduce packaging dimensions or weight? Investing in packaging design (to qualify for programs like Amazon’s Frustration-Free Packaging or SIOC Tier 2 certification) can significantly cut down fulfillment costs. Vendors who re-engineer their product packaging to be more Amazon-friendly not only avoid CRaP but often see higher customer satisfaction (less wasted space, fewer damages). In short, curate your Amazon assortment: feed Amazon products that can be profitable and hold back or reconfigure those that can’t.

- Leverage the Hybrid 1P/3P Model: The “either/or” mentality of Vendor vs. Seller is fading. Many successful brands now employ a hybrid model – using Vendor Central for some products and Seller Central for others (or even for the same product at different times). For items at risk of CRaP, a hybrid strategy is a safety valve. If Amazon stops or limits orders on a product, you can switch to selling it via 3P (either through your own Seller Central account or a trusted distributor). This way, the item stays available on Amazon even if Amazon Retail (1P) backs off. Will Haire shared multiple cases of vendors who had to pivot in exactly this way to survive CRaP issues. For example, his agency helped a brand transition a high-volume item to Seller Central when Amazon started suppressing orders; by doing so, they regained control over pricing and inventory and then slowly rebuilt that product’s Amazon presence. The flexibility of Seller Central – adjusting prices, running FBA or FBM as needed – can complement the scale of Vendor Central. As an Amazon agency, recommending a hybrid approach for clients can be a game-changer. You might keep the bulk of SKUs on Vendor, but reserve a few “insurance” SKUs on Seller, or vice versa. The key is to stay agile. In Will’s experience, having one foot in each channel often maximises opportunities (and keeps you selling even when Amazon enforces profitability cuts).

Two years ago, the talk was ‘get off Vendor and go 3P.’ Now it’s far more nuanced – a hybrid 1P/3P strategy is often the way to maximise opportunities.” — Paul Sonneveld, Co-Founder & CEO, MerchantSpring - Monitor Profitability Metrics Religiously: Amazon provides tools and reports for vendors to keep tabs on profit metrics – use them. In Vendor Central, Net PPM is king. Track it by product and over time. If you notice a slide in net PPM for a particular ASIN, investigate why before Amazon does. Also, use external calculators: the FBA Revenue Calculator (even if you’re a vendor) is handy for simulating whether a product could be profitable under Amazon’s FBA fees. If the calculator shows a very slim margin for a 3P seller, that implies a 1P relationship might also struggle. Additionally, keep an eye on Amazon’s operational costs for your category. While exact numbers vary, some estimates put Amazon’s per-unit fulfillment cost around a few dollars. Make sure your unit economics comfortably accommodate that. Agencies should set up alerts or regular audits on client accounts for things like negative profit weeks, declining trend in PPM, or sudden spikes in chargebacks and cost of goods. Early detection of margin pressure gives you the chance to course-correct (raise the wholesale price, reduce allowances, improve supply chain) before the product tips into CRaP territory.

- Negotiate Vendor Terms with Profit in Mind: Every year, Amazon vendors go through line reviews or term negotiations. Use that opportunity to protect your margins (and Amazon’s). If you know certain allowances or fees are making a product unprofitable, push back on them. For instance, damage allowances can be adjusted if your product had higher-than-expected warehouse damages; freight terms can be revisited if shipping costs soared. Will Haire recounts a case where it took a month of back-and-forth with Amazon’s vendor manager, supplying detailed cost data, but they succeeded in getting Amazon to agree to better pricing terms for a flagship product to escape CRaP status. The lesson: come armed with data on your costs and market prices. If you can show Amazon that, without an adjustment, a product will inevitably be CRaP (and thus lose them revenue), they have an incentive to find a solution – especially if it’s an important SKU. In the absence of a vendor manager, you may have to escalate through Vendor Support tickets (which is slower and can be frustrating). Nonetheless, don’t passively accept terms that doom your profitability. Negotiate for win-win terms: perhaps a slightly higher wholesale price, or Amazon reducing their required marketing coop %, or joining a program to lower fulfillment costs. Amazon has programs like Born To Run, Direct Fulfillment, and others that, if used wisely, can improve profitability or at least prevent stockouts when traditional ordering pauses.

Rescue Strategies: How to Recover a CRaPped Product

What if you’re reading this a bit late and an ASIN has already been CRaPped out? All is not lost. While it’s better to preempt CRaP, vendors can often resuscitate a CRaP product by addressing the core issues. Here’s a plan of attack:

-

Identify the Root Cause: First, determine why Amazon flagged the product as CRaP. Was the margin too low because your cost to Amazon was too high? If so, can you afford to lower your cost of goods to Amazon (or temporarily offer a deal) to get back in stock? Or was it triggered by outside price competition (i.e., you got undercut elsewhere)? If yes, stopping the bleeding on external pricing is priority #1 (cut off those channels or enforce MAP immediately). Or perhaps excessive returns pushed it over – then you need to fix the product or listing issues causing returns. Knowing the cause guides the solution.

-

Involve Your Vendor Manager (If You Have One): A good Amazon Vendor Manager can be your ally in a CRaP crisis. Reach out to them, explain the steps you’re willing to take (e.g. “We’ll improve packaging to cut weight by 10%” or “We’ve eliminated an unauthorised discounter causing price erosion”), and ask for a chance to get the item reinstated. They might recommend specific actions like increasing your damage allowance or adjusting the item’s pack size. In the best case, they can manually override and reinstate orders once convinced of the fix. Be prepared to show data or commitments (like new cost structures) to prove the item will be profitable going forward.

-

Use Direct Fulfillment to Keep Selling: If Amazon Retail isn’t ordering your product, consider turning on Direct Fulfillment (DF) for that ASIN. Direct Fulfillment, also known as 1P drop-shipping, allows you to fulfill orders to the end customer while Amazon still handles the transaction on the front end. In Vendor Central, you can enroll the product in DF so that when customers buy it, the order routes to you to ship (often within 2 days to meet Prime standards). This can be a temporary lifeline to keep the SKU alive on Amazon.com and serving customers, even though Amazon’s warehouses won’t stock it. It buys you time to fix profitability while not losing the listing entirely. (As a bonus, selling via DF means Amazon isn’t incurring fulfillment cost, so technically those sales don’t worsen Amazon’s margin.) If you’re already running a hybrid model, alternatively switch the item to FBM (fulfillment by merchant) on the Seller Central side until you can restore FBA or 1P.

-

Shift to Seller Central (3P) if Needed: In more severe cases, vendors might decide to permanently migrate a product from 1P to 3P. This often makes sense if the item simply can’t be profitable under Amazon’s retail model but can succeed with you as the seller. On Seller Central, you control the retail price, and you only pay Amazon fees when the item sells – there’s no risk of Amazon unilaterally cutting the price on you. Many brands have used this approach to “liberate” products from CRaP jail. For example, if Amazon insisted on selling a widget at $9.99 (matching Walmart) and losing money, as a 3P seller, you might set it at $12.99 and find consumers are still willing to buy, thereby restoring your margin. Keep in mind, if you do this, you should request Amazon to completely delist or “retire” the old 1P ASIN (or merge it with your new 3P listing) to avoid competing with a ghost listing. Also, coordinate with any retail partners – if you promised exclusivity to Amazon on that SKU, negotiate a change or consider a slightly different SKU/pack for 3P. Going 3P isn’t failure; it’s about choosing the channel where your product can thrive.

-

Reengineer the Offer: Sometimes the only way out of CRaP status is to come back with a new offer that makes financial sense. This could mean creating a new bundle or multi-pack, as mentioned earlier, and selling that to Amazon instead of the single unit. Or perhaps launching a new version of the product with a higher MSRP to improve margin. One creative tactic is to create Amazon-specific pack sizes that aren’t directly comparable to what’s sold elsewhere, so Amazon isn’t forced into price matching. For instance, if your 1P product was a 2-pack that became CRaP due to Walmart selling a single cheaper, you might introduce a 3-pack on Amazon only. By the time a competitor lists a 3-pack, you’ve ideally built enough momentum or can adjust. The goal is to reset the item’s economics.

-

Tighten Up Logistics: If high freight or handling costs are an issue, look at logistics programs like Amazon Vendor Flex or revising your freight shipping terms. Vendor Flex involves Amazon setting up an operation in your own warehouse, which can cut down on transportation and storage inefficiencies. It’s not available to everyone, but some larger vendors use it to great effect. Even simpler, ensure you’re using Amazon’s preferred carriers, shipping in full truckloads when possible, and meeting prep requirements to avoid chargebacks. Every saved penny in logistics is the margin Amazon gets back, which could tip an item back into the black.

-

Re-launch Marketing (Carefully): Once you’ve addressed the core profitability issues, work on rebuilding the product’s momentum. When an item was CRaP, Amazon likely stopped advertising it, and maybe it lost the Buy Box to other sellers. As you recover, consider running some advertising or deals on Seller Central (if you went 3P) to regain sales velocity. If back on Vendor, you might negotiate inclusion in Subscribe & Save again or modest AMS campaigns – but be mindful: you don’t want to spend Amazon’s money (co-op) in ways that put it back in CRaP! The focus should be on sustainable, organic profitability first, then scaling up volume second.

Recovering from CRaP can be labour-intensive, and not every item will be worth the effort. Part of the strategy is knowing when to cut bait. If, after all changes, the economics still don’t work, you may decide to discontinue that product on Amazon and focus on more profitable lines. As an agency advising brands, be ready to have that candid conversation. It’s better to redeploy resources to winners than to continually chase a fundamentally unprofitable SKU.

Future Outlook: Staying Profitable Amid Amazon’s Efficiency Push

Amazon’s new era of efficiency (spearheaded by CEO Andy Jassy’s cost-cutting focus) means the CRaP policy is not going away – if anything, Amazon is likely to enforce profitability requirements more strictly in 2024 and beyond. The retail teams are now intensely metrics-driven and under pressure to improve margins. We’ve seen Amazon raise fees on sellers, and on the vendor side, they’re scrutinising vendor terms and unprofitable items more than ever.

What does this mean for vendors and agencies? Simply put, you must build profitability monitoring into your day-to-day Amazon operations. It’s no longer just about top-line sales growth; Amazon cares about profitable growth. Vendors who proactively align with that goal will have an easier partnership with Amazon. That could mean offering more efficient assortments (fewer low-price single units, more value packs), collaborating with Amazon on programs that reduce cost-to-serve, and being ready to adjust pricing or costs when inflation or other factors hit.

On the flip side, Amazon is also working on its side to lower operational costs (e.g. optimising warehouse processes, expanding warehouse distribution, etc.). If they succeed, some items that were once CRaP may become viable. Stay informed about Amazon’s initiatives – for instance, if Amazon expands a program that lowers shipping costs for certain categories, that might allow you to revisit items you previously held back. In the webinar, Will Haire pointed out that Amazon’s drive to cut cost-to-serve has already allowed them to expand the selection of low-priced products. So, the picture isn’t all doom and gloom: it’s about meeting Amazon in the middle, with you managing your side of the profit equation.

Finally, as an Amazon agency professional, use CRaP prevention as a value-add for your clients. By implementing the strategies above, you’re not just troubleshooting – you’re actively safeguarding your client’s revenue and ensuring long-term success. Make profitability reviews a standard part of your account management cadence. Educate clients that sometimes fewer, healthier SKUs on Amazon beat a “list everything” approach that could lead to CRaP problems. In the evolving Amazon landscape, smarter selling is the only way to continue thriving.

Conclusion & Call to Action

Amazon’s CRaP policy may sound crass, but it carries a vital message: profitability matters. For vendors and the agencies that support them, the ability to stay agile and maintain healthy margins is now a core competency. We’ve covered how to identify at-risk products, proactive steps to avoid CRaP, and recovery tactics from real-world experiences. By enforcing pricing discipline, bundling wisely, leveraging hybrid channels, and continuously monitoring performance, you can keep Amazon happy and your products profitable.

In essence, avoiding the CRaP list means running a tight ship – controlling distribution, optimising logistics, and partnering smartly with Amazon. Do that, and you’ll not only steer clear of nasty surprises but also set your Amazon business up for sustainable growth.

Ready to dive deeper or need help implementing these strategies? As our experts emphasised in the webinar, knowledge is power – but action is the game-changer. If you found these insights useful, consider taking the next step:

- Watch the Full Webinar: For a more in-depth discussion and additional tips from Will Haire, check out the recorded webinar. It’s packed with nuanced advice straight from the frontline of Amazon account management.

- Subscribe for Amazon Insights: Stay ahead of Amazon’s next moves by subscribing to our newsletter. We curate the latest Amazon vendor news, policy changes, and best practices for agencies and brands. Don’t miss out on updates that could save your client’s business on Amazon.

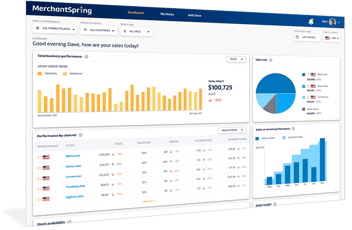

- Get a Profitability Health Check: Worried about certain products in your catalogue? Reach out to us at MerchantSpring. Our platform specialises in marketplace analytics for agencies and vendors – we can pinpoint which of your SKUs might be at risk and how to improve their performance. Contact us for a consultation, and let’s ensure your Amazon channel keeps thriving.

Keep innovating, keep optimising, and here’s to turning potential CRaP into pure gold on Amazon’s marketplace! 🚀

-Sep-30-2025-12-30-56-3050-AM.png)

Add a Comment