Boost Vendor Margins with Amazon Net PPM & Avoid CRaP-Out Risks

Overview

If you’re an Amazon vendor, there’s one profitability metric you can’t afford to ignore: Net Pure Profit Margin (net PPM). Net PPM is essentially Amazon’s profit margin on the products you supply. Why should an Amazon agency professional or vendor care about Amazon’s profit? Because it can make or break your relationship with Amazon. In a recent Marketplace Masters webinar, host Paul Sonneveld sat down with Sarah Sweet, founder of Unicorn Orange, to discuss how vendors can proactively manage net PPM. The big takeaway: Vendors who understand and improve their net PPM are far better positioned in Annual Vendor Negotiations and less likely to have products tagged as CRaP (“Can’t Realise a Profit”) by Amazon.

In this article, we’ll demystify net PPM and share practical strategies to boost this metric. Whether you’re preparing for annual negotiations or trying to prevent Amazon from dropping your products, these insights will help you protect and grow your Amazon vendor business. Let’s dive in.

“Net PPM is essentially the metric Amazon vendor managers are KPI’d against to measure profitability.” — Sarah Sweet

What is Net PPM and Why Does It Matter?

Net PPM (Net Pure Profit Margin) is Amazon’s way of measuring how profitable your 1P (first-party) vendor products are for them. In simple terms, net PPM is the percentage profit margin Amazon earns on your products. It’s calculated roughly as:

- Net PPM per product = (Amazon’s Selling Price – Your Cost Price ± Vendor terms adjustments) ÷ Amazon’s Selling Price

Amazon considers factors like your cost of goods, any negotiated trade terms or discounts, and their selling price to compute this margin. (Operational costs on Amazon’s side, like fulfillment, are typically excluded from net PPM calculations.) The result is a percentage that tells Amazon’s retail team how profitable each product is.

So why does net PPM matter to you as a vendor? Because Amazon uses net PPM to make big decisions about your products(catapult-analytics.com). If a product’s net PPM is too low (or negative), Amazon may start treating it as a loss-maker. In Amazon lingo, such items are at risk of being labelled CRaP (“Can’t Realise a Profit”). And when that happens, Amazon might take actions like: removing your ability to do A+ content on the listing, stopping any price matching (losing the Buy Box to other sellers), pausing your advertising, or ultimately ceasing to order the product altogether(catapult-analytics.com). In short, low net PPM can get your product dropped from Amazon’s assortment, which is a vendor’s nightmare.

On the flip side, maintaining a healthy net PPM means Amazon has a win-win incentive to keep buying and selling your products. Amazon is first and foremost a retailer in the vendor model – if they’re not making money selling your item, they’re not obliged to continue buying it from you. As Sarah Sweet emphasises, vendor managers at Amazon live and breathe net PPM as a core KPI. They are literally targeted on improving category profit margins, so your net PPM performance directly affects how they manage your account.

Amazon’s Benchmarks: How Much Profit Does Amazon Expect?

It’s logical to assume that acceptable net PPM targets differ by category – and they do. Amazon doesn’t publicly publish net PPM benchmarks per category (and these can shift with Amazon’s internal goals), but industry experience gives us ballpark figures. Generally speaking:

- Hardlines (durables, electronics, etc.): ~40–45% net PPM target

- Softlines (apparel and accessories): ~30–37% net PPM target

- Consumables (groceries, health & beauty): ~27–35% net PPM target

(These ranges are approximations that can vary by sub-category and over time. Always confirm with your Amazon vendor manager if possible.)

As you can see, categories with traditionally slimmer retail margins (like consumables) have lower net PPM expectations, whereas categories like electronics or home goods see higher percentage margins. Amazon vendor managers will compare your account’s performance to such category benchmarks. If you’re below the benchmark, expect it to be a point of contention in discussions or Annual Vendor Negotiations. If you’re above, you likely won’t hear much about net PPM – which is a good sign.

Keep in mind that Amazon’s profitability focus has sharpened in recent years. A few years ago, Amazon was all about growth and selection expansion; profit was secondary. But today, after shifts in strategy, layoffs, and pressure for retail profitability, Amazon is laser-focused on making money on every product they carry. Net PPM is the lens through which they evaluate that. Vendors who understand this new reality will be better prepared to meet Amazon’s expectations.

Net PPM in Annual Vendor Negotiations (AVN)

Annual Vendor Negotiations (AVN) is the time of year when Amazon proposes changes to your trading terms – often asking for deeper discounts, higher accruals, or other concessions that impact their margin. Net PPM plays a central role in these talks. Here’s how:

- If your net PPM is below target: Amazon will almost certainly push for cost concessions. For example, they might ask for an additional X% off invoice costs, increased marketing co-op, or other terms that effectively improve their margin by a certain number of basis points. It’s not uncommon to hear something like, “We need to improve net margin by 150 basis points this year.” They are trying to close the gap to their category benchmark or internal profit goals. In essence, the lower your current net PPM, the tougher the negotiation stance from Amazon. They may threaten to curtail orders or even “CRaP out” specific low-margin products if improvements aren’t made.

- If your net PPM is on target or above: You have a stronger position. Amazon might focus on other things in negotiation (like asking support for marketing or growth initiatives) rather than pure margin. As Paul Sonneveld noted, if Amazon isn’t bringing up net PPM as an issue, you’re probably in a healthy place. Still, complacency is risky – you should proactively monitor your net PPM to ensure it stays healthy as costs and prices change over time.

A key point Sarah Sweet made is to separate trading terms increases from net PPM improvement. Amazon may ask for an overall trading term increase (e.g., +5% in coop/rebates), but that alone doesn’t guarantee products will be profitable if your cost prices or market prices are out of line. Vendors need to look at net PPM both at an account level and an individual product (ASIN) level. Amazon certainly is looking at both. In some cases, Amazon might tolerate a few low-margin “loss leader” products if they are crucial for selection (high sales velocity items that customers expect to find on Amazon). But they will then expect higher margins on the rest of the catalog to compensate – they manage to a total portfolio net PPM.

Bottom line: In AVN prep, know your numbers. Run your Amazon vendor profitability reports (Vendor Central has a Net PPM report under Retail Analytics) and identify which products drag down the average. If you can address those proactively (through cost changes or other means discussed below), do it before negotiations. And when you do concede something to Amazon in terms negotiations, get something in return – more on that in a moment.

The Consequences of Low Net PPM: Avoiding the “CRaP-out”

We’ve hinted at Amazon’s CRaP policy – here it is in plain terms: if Amazon can’t realize a profit on your product, they eventually stop selling it(catapult-analytics.com). The CRaP-out process can happen in stages, and it’s not always explicitly communicated. Signs your product is entering CRaP-out territory include: Amazon stops price-matching your item (so the Amazon price stays high relative to competitors, causing sales to drop), they remove or refuse to implement your A+ Premium content, you find you can’t create Sponsored Product ads for it anymore, and ultimately, Amazon may stop sending purchase orders for that ASIN. Once a product is fully CRaP-out, Amazon’s listing goes away or shows as “Currently unavailable.” Your revenue on that item goes to $0, literally overnight.

No vendor wants this. The risk is highest for products with low or negative net PPM. For instance, if after subtracting Amazon’s costs a product loses money on each sale, it’s a prime CRaP candidate. Avoiding CRaP-out means keeping an eye on net PPM and taking action before Amazon does. One proactive step is to calculate “Amazon’s net profit per unit” for your items(catapult-analytics.com). If a certain product yields say $-0.50 per unit to Amazon (negative profit), it’s at high risk. You may decide to reframe the product offering (e.g., introduce a profitable bundle or a slightly different pack that can be priced higher), or cut it from your Amazon assortment yourself in a controlled way, rather than waiting for Amazon to cut it for you. However, as Sarah noted, be careful with this approach for major brands: simply delisting your top seller on Vendor Central could harm your relationship if that product drives a lot of Amazon’s revenue. It might be better to find a way to make it profitable (through cost reductions or other means) than to pull it, especially if you’re a large vendor.

To sum up the stakes: healthy net PPM = Amazon keeps buying; poor net PPM = product likely gets yanked. Now, let’s shift to the positive side – what you can do about it.

Strategies to Improve Your Net PPM (and Amazon Vendor Profitability)

Improving net PPM requires a mix of financial strategy, assortment planning, and operational tactics. Amazon will often default to one suggestion: “Just lower your cost prices.” While negotiating better factory costs or economies of scale is important, we know it’s not always feasible in the short term. The good news is, there are many levers a vendor can pull to boost Amazon profitability. Below we outline the key strategies discussed in the webinar, along with additional insights on each:

1. Optimize Costs and Pricing

It sounds obvious, but it’s worth stating: reducing your cost of goods (COGS) directly raises Amazon’s margin and your net PPM. Amazon’s vendor managers often urge vendors to “go back to your manufacturer and find a way to cut costs”. This might involve value-engineering your product, sourcing raw materials more cheaply, or improving production efficiency. If you can lower your unit cost and pass that on to Amazon as a lower vendor cost, net PPM will improve.

Beyond product COGS, look at logistics and operational costs on your side. For example, can you optimize how you pack or ship to Amazon to reduce chargebacks or routing fees? Programs like Amazon’s Pan-EU Inbound Consolidation Service (PICS) can streamline warehouse deliveries across Europe, potentially lowering Amazon’s handling costs (and thus they might not need as large a margin). If you incur fewer stockouts, fewer chargebacks, and ensure efficient fulfillment, Amazon’s cost to serve you is lower, indirectly supporting profitability.

On the pricing front, examine your ASP (Average Selling Price) on Amazon relative to your costs. Sometimes, small strategic price increases are viable if your product’s value supports it and if the market isn’t too price-competitive. Remember, net PPM uses Amazon’s selling price in the formula – a higher selling price (with cost held constant) means higher margin%. Just be mindful of Amazon’s price matching: if you raise your list price but your product is widely available cheaper off Amazon, Amazon will drop their price to match others, eroding margin again. That’s why aligning with outside retailers is important (we’ll cover that soon). Also, consider dynamic pricing strategies – if you have seasonal demand or less competition at certain times, you might maintain a higher price (and margin) during those periods and only drop price when needed.

Bundle and upsell: One pricing-related approach Amazon often suggests is creating product bundles or Amazon-exclusive packs. The idea is you can set a unique, higher price that isn’t directly comparable to a single unit sold elsewhere, thereby preserving margin. For example, if a single unit has a thin margin, perhaps a 3-pack or a value bundle can be sold at a better cumulative margin. Amazon loves bundles if they increase the Average Order Value and profitability. Similarly, Amazon exclusives (a product or variation only sold on Amazon) can be priced without outside price pressure. However, as Sarah cautions, an exclusive still has to be compelling to customers. You can’t just slap an “exclusive” label and charge 20% more for the same thing — you might need to add value (e.g., a gift packaging, an extra accessory, a unique flavor) so that the item can carry a higher price that yields profit while still selling.

2. Diversify and Optimise Your Product Portfolio

One of the smartest strategic moves is to shift your sales mix toward higher-margin products. Sarah Sweet calls this “catalogue diversification,” but it really means focusing on the winners (from a profit perspective). Start by analysing which of your ASINs have above-average net PPM and which are dragging the average down. Then consider ways to drive more traffic and sales to the high net PPM ASINs and relatively deemphasise the low net PPM ones. This doesn’t necessarily mean cutting low-margin items entirely (especially if they are important for revenue), but you can adjust your focus:

- Invest more in marketing the profitable items (ads, deals, merchandising).

- Ensure the content (images, copy) and conversion elements (reviews, A+ content) on those ASINs are top-notch to maximise their sales potential.

- If you have borderline products that could be profitable with a small cost tweak or slight price raise, prioritise fixing those.

Sarah shared a powerful example of this approach: by doubling down on high-margin ASINs, her team boosted one client’s net PPM from 6% to 27% over 20 months – a huge improvement(catapult-analytics.com). They did it by “really drilling down into the numbers” and redirecting demand to the right products.

“We actually boosted net PPM by 6% to 27% over 20 months by really drilling down, understanding those high net PPM products and redirecting sales there.” — Sarah Sweet

To execute this, you may need to adjust your advertising strategy (see next section) and even reconsider internal sales incentives or focus. If your sales team or distributors have traditionally pushed whatever sells the most units, you might refocus them to push the products that are healthiest for Amazon profitability. Internally, it’s a shift from pure top-line thinking to profitable top-line thinking.

Also, evaluate if any products should be retired from Amazon. If an item consistently has a very low net PPM and there’s no feasible fix (e.g. costs are high and you can’t raise the price due to competition), it might be better to pull that item from the Vendor catalog. You could potentially move it to a 3P (Seller Central) model if it still sells (so you’re not forcing Amazon Retail to take a loss – you or a third-party seller handles it). Or discontinue it entirely if it’s not strategic. Keep in mind, Amazon looks at your account holistically too; if you remove a low-margin but high-volume item, your overall net PPM may shoot up, but Amazon might not be happy losing that volume. Hence, communicate and plan such decisions carefully.

3. Leverage Advertising and Deals (Strategically)

It may sound counterintuitive – why spend on advertising if Amazon doesn’t count ad spend in net PPM? The reason is to drive more profitable sales volume. Advertising can be a tool to increase the sales of your high-margin products. Since ad costs come out of your pocket, not Amazon’s, they don’t hurt net PPM (Amazon sees the same revenue and cost from their side whether you advertised or not). Of course, you care about your own P&L, so you must balance ad spend ROI. Focus on efficient ad campaigns that can scale up the sales of profitable ASINs. For example, run Sponsored Product ads targeting competitor or category keywords for a high-net-PPM item, especially if it’s not yet a bestseller. The increased sales velocity can improve its ranking and make it a larger part of your Amazon revenue mix, thereby lifting your account’s overall net PPM.

Another lever is Amazon’s Deals and promotions. Running price promotions might seem to reduce margin, but if done wisely, it can pay off in volume and downstream effects. Deal events like Prime Day, Black Friday, or Cyber Monday offer massive traffic boosts. If you feature a product that already has a healthy margin in a Top Deal or Lightning Deal, the sales spike can more than compensate for the discount given, and Amazon loves to see vendors support big events. Sarah recommended aiming for “Top Deals” on Vendor Central during major events – these get the best visibility. In her experience, a client saw over 1000% uplift in sales on Prime Day when they secured a high-profile deal placement for a key product. That kind of jump not only drives immediate revenue but also can lead to repeat customers and improved organic rank after the event.

“We had one client that had over 1000% uplift on Prime Day. You can get some significant uplift from it.” — Sarah Sweet

When planning deals, be strategic about which products you put on the deal. Ideally, promote those with solid net PPM (so even on a deal, Amazon makes some profit, and you gain market share). Avoid cutting already slim margins to the bone; instead, use deals to increase share for products where you have wiggle room. Also, negotiate with your vendor manager – if Amazon wants you to fund a big promo, perhaps that could count toward some of the margin improvement they seek.

One more advertising tip: consider defensive ad targeting that actually helps with profit. For example, on Amazon, you can run Sponsored Display or Product targeting ads from your high-margin ASINs onto your own low-margin ASINs’ pages. This way, if a customer lands on a low-margin product (perhaps it’s popular), they see an ad for your more profitable alternative and might switch. It’s a way of nudging customers toward the products you want them to buy. Similarly, ensure your Amazon Brand Store highlights your hero products (the profitable ones) prominently, and use Amazon Posts or other free content to showcase them.

Finally, conversion rate optimisation is an often overlooked profitability lever. Higher conversion means more sales at the same traffic, which improves Amazon’s economics too. Ensure all your top products have high-quality content: A+ Content (enhanced product descriptions), good videos, and plenty of positive reviews. Sarah mentioned using A+ Premium content – a feature that normally costs extra money for vendors. Her hack: enroll the product in Seller Central (if possible) and attain A+ Premium (which is free for sellers meeting certain criteria), then that premium content will reflect on the Vendor listing too. Using premium modules like video, comparison charts, etc., can boost conversion by up to 8-10%, which can meaningfully improve sales and, by extension, Amazon’s total profit dollars (if not the percentage).

4. Align Retail Pricing and Promotions Across Channels

One of the more complex but impactful strategies discussed was aligning your pricing and promo calendar across all retailers. Amazon’s algorithm relentlessly price-matches major off-Amazon competitors. If your product is on 30% off at Walmart or Tesco this week, Amazon will likely price-match that discount (funded out of their pocket), shrinking their margin. If this happens sporadically, it’s not a big issue; but some brands find their products on perpetual promotion because different retailers take turns discounting. The result: Amazon is almost always selling at a discount and net PPM stays low or volatile.

To combat this, coordinate your promotional calendar with other retail partners. For example, instead of a situation where Retailer A does a big sale in Week 1, then Retailer B in Week 2, and Amazon is price-matching all month, try to get them to align promotions in the same time window. It’s tricky (and not always fully in your control), but some brands manage an industry practice where, say, all major retailers run their promo in the same 2-week period each quarter, and then no promos for the next 6 weeks. During those off-promo periods, Amazon’s price can return to normal, and they earn full margin. This requires a lot of planning and negotiation with retail partners, but it can effectively raise your average selling price on Amazon over time, thus improving net PPM.

Sarah noted that since mid-2023, Amazon has even adjusted how it price-matches certain promos like loyalty card discounts. For instance, if a competing supermarket offers a lower price only for loyalty card holders, Amazon’s algorithm might ignore that (since it’s not a general public price). It’s worth monitoring such developments – in some cases, you might not need to match every promo if Amazon isn’t going to price-match it due to technicalities.

The broader point here is to minimise constant price erosion on Amazon through better channel management. Work with your sales team or distributors to avoid grey-market sellers undercutting Amazon too. If unauthorised 3P sellers offer your product cheaply, Amazon will often price-match them as well or lose the Buy Box, both scenarios that hurt your sales or margin. So, enforcing MAP (Minimum Advertised Price) or having tight distribution controls indirectly helps keep Amazon’s net PPM stable.

5. Negotiate Smarter Vendor Terms (Get Something for Giving Something)

When Amazon asks for a higher discount or more fees during AVN, remember that everything is negotiable. If you must concede additional margin to Amazon, ask for value-add services in return that help your business. For example, consider negotiating for:

- Co-op funding for marketing: If you give Amazon an extra 2% back, maybe request Amazon to fund some marketing initiatives or merchandising placements in return (sometimes called Joint Business Plan opportunities).

- Amazon Vine credits: If launching many new products, you could ask for free Vine enrollments to get reviews, offsetting the marketing cost you’d otherwise bear.

- A+ Premium access: Amazon may waive the fee for A+ Premium content as part of the terms – this saves you money (and helps boost conversion).

- PICS (Pan-EU Inbound Consolidation Service): This is a logistics program that can significantly cut down your hassle and cost in sending goods to multiple Amazon fulfillment centers across Europe. If relevant, getting Amazon to enroll you in PICS (or offer better terms on it) can save you storage and transport fees, offsetting margin given.

- Damage allowance adjustments: Sometimes, you can negotiate lower damage or return allowances if your history shows low returns. Every little bit counts.

The idea is to make trade-offs that align with your priorities. If Amazon wants +5% margin but you know you’ll be doing heavy product launch activity, maybe you agree but in return Amazon provides $50k in free marketing or events throughout the year. These kinds of quid pro quo can make a big difference.

Also, structure the terms smartly: Instead of giving a blanket cost discount which applies to all items (including those that are already profitable), you might negotiate a conditional discount or growth rebate that only applies if certain sales targets are met. That way Amazon has skin in the game to grow your business, and you maintain flexibility.

Lastly, document any side agreements. If a vendor manager verbally assures you of something in exchange for terms, try to get it in writing (even an email). Vendor managers turn over, and you want to ensure the promises hold.

6. Continuously Monitor and Adjust

Improving net PPM isn’t a one-and-done project. Make it a habit to monitor your net PPM quarterly or monthly via Amazon’s reports or using a third-party analytics tool. Track the trend: Is it improving or slipping? Identify causes – e.g., did a cost increase on your end drop the margin? Did a new 3P seller start undercutting prices? Regular monitoring lets you take corrective action quickly (raise a price, cut an unnecessary cost, etc.) before it becomes an end-of-year crisis.

In addition, stay in communication with your Amazon vendor manager or Amazon Vendor Services (AVS) contact if you have one. No surprises is a good motto – if you foresee margin pressures (say, commodity prices rising for your goods), inform them and present a plan for mitigation. It shows proactiveness and can buy goodwill.

Quick Recap – Key Ways to Boost Net PPM:

- Optimise your COGS and logistics (negotiate better costs, reduce chargebacks, consider Amazon programs that lower fulfillment costs).

- Raise prices strategically where possible and avoid endless price matching by aligning promotions.

- Emphasise high-margin products in your Amazon assortment; push their sales via ads and great content.

- Use bundles or exclusive packs to your advantage to escape direct price wars.

- Invest in conversion (A+ content, reviews) to maximise sales at current prices.

- When giving Amazon higher discounts, get compensated with support or services.

- Always monitor the data and be ready to adjust course.

Conclusion: Thrive in the Profitability-Focused Era of Amazon Vendor Management

Amazon has made it clear: vendor profitability is now front and center. Net PPM, once just another line in a report, has become the North Star metric for Amazon’s vendor managers and a critical factor in whether your products stay listed and thrive or get cut due to low margins. The good news is that as a vendor or agency professional, you are not helpless – by applying the strategies above, you can proactively manage net PPM instead of reactively scrambling when Amazon flags an issue.

Start by ensuring you understand your net PPM numbers at both the total account and individual product level. Then take action to improve them: maybe it’s renegotiating a cost, maybe it’s smarter pricing, maybe it’s shifting focus to a more profitable hero item or creating a fresh bundle that customers love and Amazon can support. These are the kind of savvy moves that not only safeguard your relationship with Amazon but also improve your own bottom line in the long run. Remember, the goal is a win-win: Amazon makes money selling your product, and you make money selling through Amazon.

In this era, vendors who treat Amazon as a true partner – focusing on mutual profitability – will have the edge. You’ll find Amazon more willing to support your growth, feature your items, and maybe bend less on price matching, because you’ve shown you’re aligned with their goals.

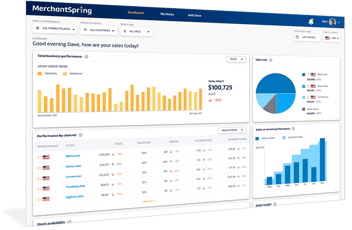

If you found these insights useful, be sure to watch the full webinar on demand for a deeper dive and additional Q&A with Sarah Sweet. (It’s available in our resources library – don’t miss the nuanced examples she shared.) And if you’re looking to take your Amazon vendor analytics to the next level, including tracking net PPM effortlessly, consider leveraging tools like our new MerchantSpring Vendor Profitability module. It consolidates all those cost, price, and fee inputs to give you a clear view of profitability by ASIN and account – a game changer for making data-driven decisions.

Finally, stay tuned for more content in our Marketplace Masters series. We’re all ears for what Amazon vendor topic you’d like to see covered next – drop me (Paul Sonneveld) a message on LinkedIn with your suggestions. Let’s master the marketplace together!

Until next time, happy selling and profitable partnering with Amazon!

-Aug-20-2025-06-39-39-9599-AM.png)

Add a Comment