How to start selling on amazon UK (and into the rest of Europe)

Why sell on Amazon and why access UK markets?

Amazon’s customers are spread out over 178 countries globally.

So every seller should think of selling on amazon UK and globally.

With Amazon listing over 3 billion products across 11 marketplaces worldwide, the ecommerce platform has a truly global outlook.

You could gain a lot from expanding your horizons as a seller on Amazon. Here’s why.

Firstly, as a seller, why sell your products on Amazon to begin with? We’ve summarised why Amazon is a great platform for your products.

Amazon’s credentials really do speak for themselves. If you’re operating your business from Australia, for example, and are looking to expand into the UK, Amazon offers a niche set of qualities. As a well-established platform, it’s the perfect way to make this global transition.

- Exposure: The level of traffic that Amazon generates can have a vast impact on your sales. In December 2019, Amazon.com had over 2 billion site visits globally. They have a vast global customer body. Posting your listings on their sites is sure to expose you to these customers.

- Cost efficiency: We’ll go into the costs associated with selling on Amazon in just a bit. But on the whole using Amazon is a cost-efficient way of selling your products. With no fixed costs for shipping and handling and no listing fees Amazon is great for keeping costs down.

You’ll also be able to play around with a sales strategy as you test your brand on the online marketplace.

There are subscription fees associated with being a professional seller and selling fees if you’re a casual seller (we’ll go into more detail on this later.)

- Trust: If you’re starting out, building up a customer pool of people that trust you and your brand takes time. Using Amazon as a marketplace could make up for this.

Amazon is a well recognised and consequently well trusted marketplace. With a secure payment system, consumers may be more likely to purchase your products via Amazon than your own individual website.

As a marketplace with customer loyalty and trust at the centre, your products and business could really benefit from this.

- Market awareness: Starting selling on Amazon Marketplace allows you as a seller to dip your toe in the water, so to speak. You’ll be able to list your products on the marketplace and by doing so, gain a greater understanding of your market area.

By viewing competitor prices and competitor marketing methods you’ll be able to build an intelligent pricing and marketing strategy.

- Unified markets: Selling to Amazon UK gives you access to not only Amazon UK, but Amazon Germany, France, Spain and Italy, all from one Amazon Seller Central. With no additional work, you can be accessing a huge number of European customers.

Also read : Are you an Amazon Vendor? Here is guide to drive sales!

Expanding internationally

Since Amazon unified its European marketplaces sellers can now access

- Amazon UK (Amazon.co.uk)

- Amazon Germany (Amazon.de)

- Amazon France (Amazon.fr)

- Amazon Spain (Amazon.es)

- Amazon Italy (Amazon.it)

This means, as a seller you can have access to all of these Amazon sites without setting up different accounts. Retailers can handle operations in all European markets from just one Seller Central Account.

You could see a huge increase in revenue and a real boost to your business.

In addition, you can test new international markets, without too much investment.

Now you know all the benefits of selling on Amazon marketplaces and starting on Amazon.co.uk you’re probably wondering how best to get started and the costs involved.

Here’s the ultimate guide to get you started.

Getting started

The most daunting part of the process is perhaps the beginning part. Getting started can seem like an overwhelming first step.

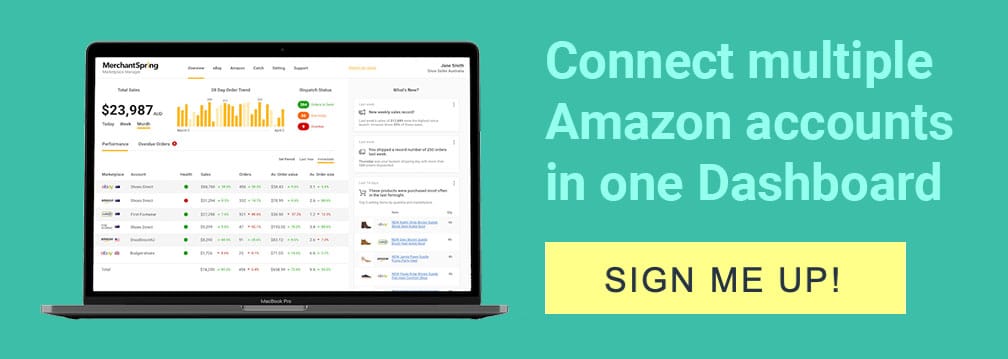

We recommend you don’t take this step alone. Investing in a seller tool such as Marketplace Manager will ensure that your strategy to going global is in good shape.

You’ll be sure to get started on the right step and have access to key market insights as you start to expand.

Are you a casual or a professional seller?

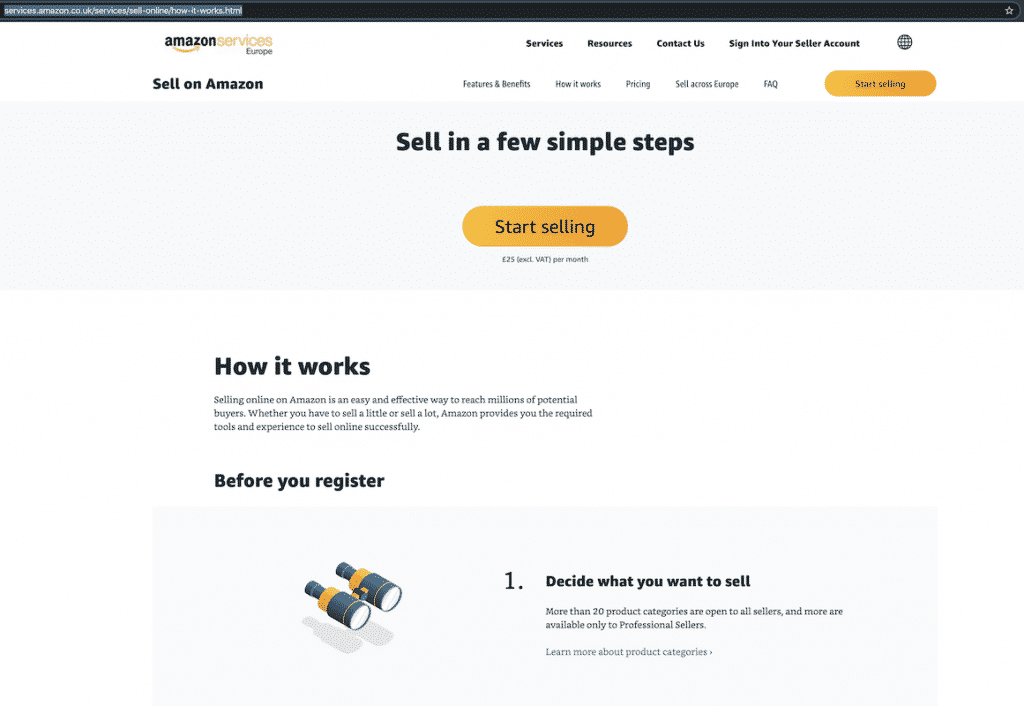

If you’re expecting to sell less than 35 products a month, then you’ll register as a casual seller. For the majority you’ll want to register yourself as a professional seller.

For a subscription fee of 25GBP per month (not including VAT) you’ll be able to sell and list as many products as you wish. It’s likely if you are selling lots of product, this overhead is affordable.

Setting up an account on Amazon.co.uk

The first step to setting up on Amazon.co.uk is to head to the Amazon.co.uk website and create a seller account.

You’ll need a UK-based credit card and billing address with which to pay your Amazon fees. This information will need to be provided within your account setup, along with an email address, phone number and VAT number (if your company is registered for one.)

You’ll also need to provide a full valid passport, National ID card and Utility Bill, Bank Statement or Credit Card Statement addressed to the individual and dated from the past 90 days.

For a more comprehensive list of what you’ll need to provide, head over to their website.

When selling on Amazon’s unified marketplace you’ll have the option to setup a UK business, or continue selling with an existing international business.

There are pros and cons to both options, and you’ll have to decide for yourself what is best for your business. We’ve summarised the positives and negatives to each situation.

- Using an existing international business: With this option you’ll have to register for VAT and start paying UK sales tax immediately. If there is an error that occurs when selling on Amazon.co.uk marketplace, it could put both your seller pages in jeopardy. Possibly leading to suspension.

- Registering a new UK business: With this option, you won’t need to register for VAT immediately and your UK and domestic accounts will remain as separate entities. The inconvenience occurs when you have to register your UK business. This can be a timely process.

Registering products for selling on Amazon

How to register your product onto Amazon’s marketplaces

Registering products on Amazon is a fairly simple process.

As a casual seller all you have to do is look for the blue box that says “More Buying Choices,” on Amazon.co.uk’s product page. It’ll be on the right hand side of the page.

There will then be an option to select a “sell yours here” button. All you have to do is enter details about the condition of the product, the age and an additional comment.

The process is slightly different for a professional seller. Using the Amazon Seller Central or its bulk listing tools, you’ll be able to list your products.

If the product already exists in the Amazon.co.uk catalogue you can proceed and list each item individually. You can do this by using Amazon’s web-based interface. All you have to do is enter the ASIN, the price and your available stock.

You can also make use of Amazon’s bulk listing tools. Provide the EAN, ISBN or UPC codes for each product.

If however, the product does not exist in the Amazon.co.uk catalogue you can create them using the web-based interface of the bulking listing tools.

You’ll have to provide the following product information*:

- EAN, UPC or ISBN code

- Product description and title

- Product image (be sure to read our guide to perfecting the art of eCommerce photography.)

- Price

- Available stock

*This is not an extensive list and in some categories you may need to provide some additional information.

Product restrictions

Amazon has a range of product restrictions within different categories. There are some categories with no restrictions, and somewhere additional permission is required.

Note that on Amazon marketplace, sellers are permitted to sell within the following categories:

- Automotive

- Baby

- Books

- Business

- Industry and science

- Electronics

- Home

- Home improvement

- Kitchen

- Law and garden

- Luggage

- Amazon device accessories (excluding Kindle batteries)

- Musical instruments

- Office products

- PC

- Shoes

- Software

- Sports

- Toys and games (exceptions apply over the Christmas period)

- Video

- DVD and video games

Additional permission is required for these categories:

- Alcohol

- Animals and Animal Products

- Car & Motorbike

- Clothing

- Cosmetics

- Currency, Coins, Cash Equivalents and Gift Cards

- Drugs, Drug Paraphernalia and Dietary Supplements

- Electronics

- Food & Beverage

- Gambling & Lottery

- Hazardous and Dangerous Items

- Jewellery

- Medical Devices

- Offensive and Controversial Materials

- Other Products

- Sex & Sensuality

- Tobacco, E-Cigarettes and Related Products

- Weapons

However, the following products are forbidden for sale on Amazon marketplace:

- Illegal products (illegal drugs, guns and ammunitions)

- Prescription medicine

- High strength alcohol (70% ABV+)

- Tobacco

- Real fur clothing

- Used clothing and shoes

- Lottery tickets

Costs involved when you sell internationally

When selling across borders you often run into additional postage and customs costs. There are also things to be aware of when it comes to dealing with currency and exchange rates.

Here’s a quick summary of all the things to be wary of when you start selling on Amazon.co.uk.

What you need to know about VAT

VAT is a value added tax placed on goods. When importing goods into Europe (UK included), you must be aware of this tax as it is your responsibility to collect this tax and pass it on to local tax authorities.

First thing you need to do is apply for an EORI number (economic operator registration and identification number.) This should take 3 days to process. This is your number to use when declaring imported goods to customs.

By using this, along with a commodity code, customs officers will be able to check the legalities of your items and if any duty needs to be paid. Paying these duties has to be allowed before your product is permitted to enter the UK or Europe.

Registering for VAT: If you don’t register for a UK business you’ll have to register for VAT immediately.

However, if you have registered for a new UK business, you won’t have to worry about paying VAT until you hit the VAT threshold of 85,00GBP.

After VAT registration you must charge VAT on eligible sales and reimburse this money to UK tax authority HMRC. (The current VAT is set to 20%. You can use a tool to help calculate how much VAT you’re paying.)

Once registered it is possible to claim back the VAT paid on some business costs.

With Amazon Seller Central Account, you can register for VAT and file your reports and submissions.

If you are a non-EU Amazon seller, you can use this service for a fee of around 400 Euros, per year, per country.

Be prepared to provide your business documentation and details of your banking arrangements when using this service. More detail on the process is accessible from Amazon’s website.

How to sell in a currency that isn’t your local

You have to be prepared for selling products in your own currency. There are two options here:

- Open a bank account in the countries you’ll be selling in

- Use a tool like Payoneer to switch between currencies

Using a domestic bank account for sales could see you being charged huge conversion fees, leading to a great expense for your business.

Payoneer:

Payoneer allows you to make cross-border payments on marketplaces. With lower fares, you’ll be able to keep more of your earnings too.

On your seller account on Amazon, you can add your borderless details. This way you can take payment in a range of currencies and withdraw the income into your chosen currency when you’re ready.

When and how do you get paid?

Every fourteen days, money from your sales will be deposited in your bank account. You’ll receive an email notification once a payment has been sent.

Managing your shipping and storage process

Amazon have strict guidelines when it comes to shipping regulations. Products must be shipped within two days of the seller being notified of it being sold.

Funds will only be credited to the seller’s account when confirmation of dispatch has been proven.

All progress of an order and transaction is displayed on your Amazon Seller Central Account.

If you are autonomous for the process of delivery then it is your responsibility to pack and deliver the product.

The option does exist, for Amazon to be in charge of the delivery process.

Fulfilment by Amazon

This is an incredibly straightforward process. You upload your listings, make a sale, and then ship your item to an Amazon fulfilment centre in Europe, where Amazon takes care of the rest.

Packing, distributing, inventory and customer storage is all taken care of.

You store your products in an Amazon fulfilment centre and Amazon takes care of the rest.

While there are no added set-up charges or subscription fees, you will have to pay fulfilment and storage fees, which vary according to item dimensions, weight and necessary shipping methods.

These fees vary over the Christmas period due to excess stock.

Fulfilment by Amazon is a good option to consider if you are expecting to shift a lot of stock, otherwise it could not be cost effective.

Top tips for selling internationally

Check the restrictions

Before you start selling and investing time into promoting your listings, make sure that the products you are looking at selling don’t have any Amazon restrictions in the countries you are looking to sell to.

Amazon UK and EU have regulations on products that you must educate yourself on as a seller.

Be especially careful if you are looking to sell medical, cosmetic, electronic, food and beverages products.

Use a seller tool for key insights

Use a seller tool such as Marketplace Manager to maximise your marketplace success. monitoring account performance, sellers will receive custom insights into their performance.

Marketplace Manager provides you with a fully listed quality diagnostic and provides opportunities to improve search ranking immediately.

By using a seller tool such as Marketplace Manager you’ll be able to adapt a sales strategy that works best for you, shaped by insights and analytics adapted to your business model.

Currency conversions

Look into the best way to avoid being charged conversion fees but are instead converting your currency at a mid-market rate.

Market trends in Europe

Having an understanding of European markets and key sales periods is sure to help you out when it comes to making those sales.

As these may vary to holidays in your home country, make sure you do your own research into this.

Conclusion

Selling on Amazon UK marketplaces and taking advantage of the unified platform could see you gaining access to a huge customer base.

Not only does Amazon foundational selling points as a marketplace, but it is also a great way of expanding your business internationally, with limited work.

Understanding the process of getting started, products to avoid selling and those to invest time into and the cost involved will make the process as efficient as possible.

Investing in a seller tool, such as Marketplace Manager can see you get the most of expanding internationally. You’ll be able to use key insights and analytics to make your business grow dramatically.

Take your Amazon business international today and you won’t regret it.

Add a Comment